HEALTH COACHING

Build Habits for Health Excellence

Private virtual coaching to achieve your health goals.

the Health epidemic

people Are Living Shorter, Sicker, and sadder lives

Many are living unhealthier today than ever before. They’re prediabetic, overweight, depressed, and lack the energy to do anything about it.

And ignoring these issues has detrimental effects. Not only is disease, disability, and early death inevitable, but your enjoyment of life diminished.

But I’m here to coach you to health excellence. To fix all that. Together we’ll build habits that over time accumulate to produce remarkable results.

years of experience

About me

The Right Coach Makes all the Difference

“It’s one thing to understand evidence-based healthy habits. It’s another to implement them. Let’s do both.

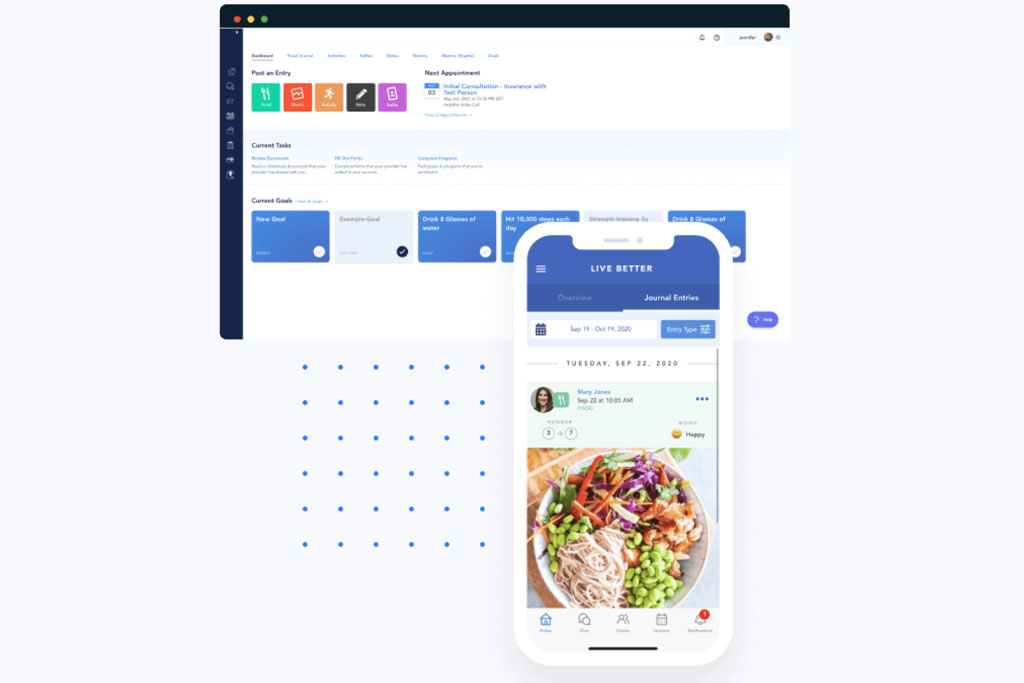

YOUR Health Assessment

the most robust health assessments available

Let’s start by gaining a complete picture of your lifestyle and habits. Then compare those to nationally recognized guidelines to identify health gaps.

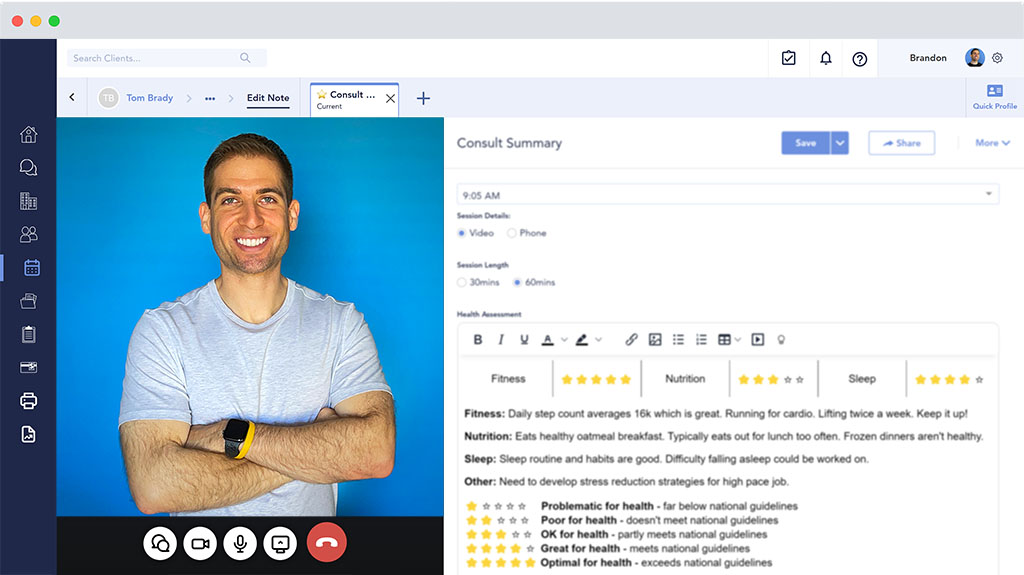

YOUR Coaching Session

Private Virtual Consultations

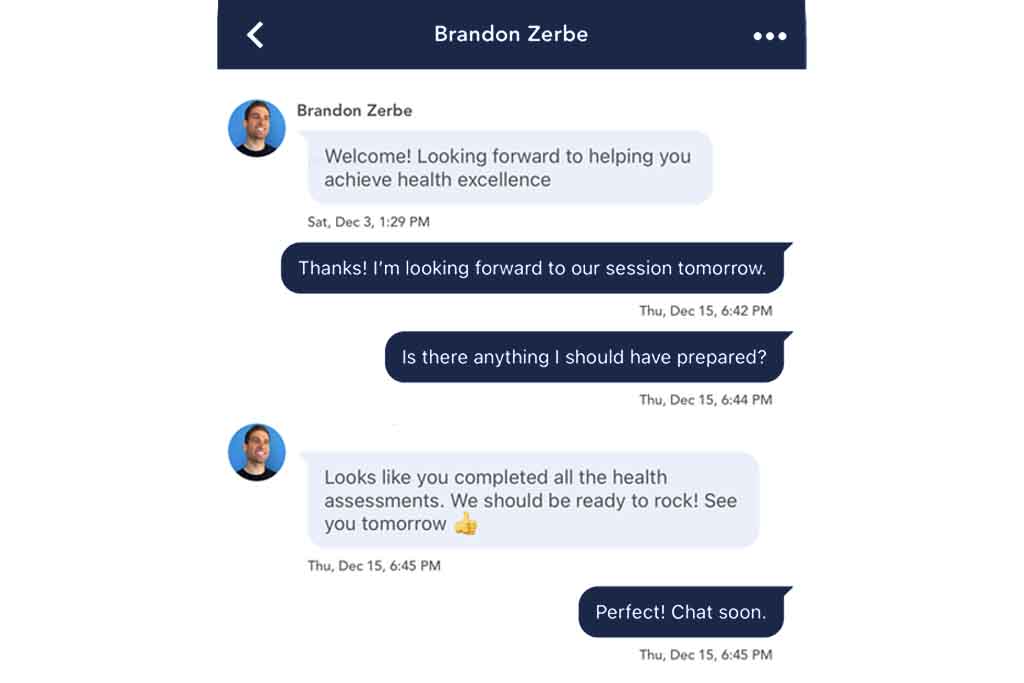

Then we’ll meet for a 60-minute video or phone conversation to discuss the assessment results. We’ll cover your goals, questions, and concerns. Finally, we’ll develop a plan to get results.

Coaching Process

How it Works

Get meaningful results with a straightforward process.

1.

Schedule Consult

Choose a 60-minute session that fits your schedule.

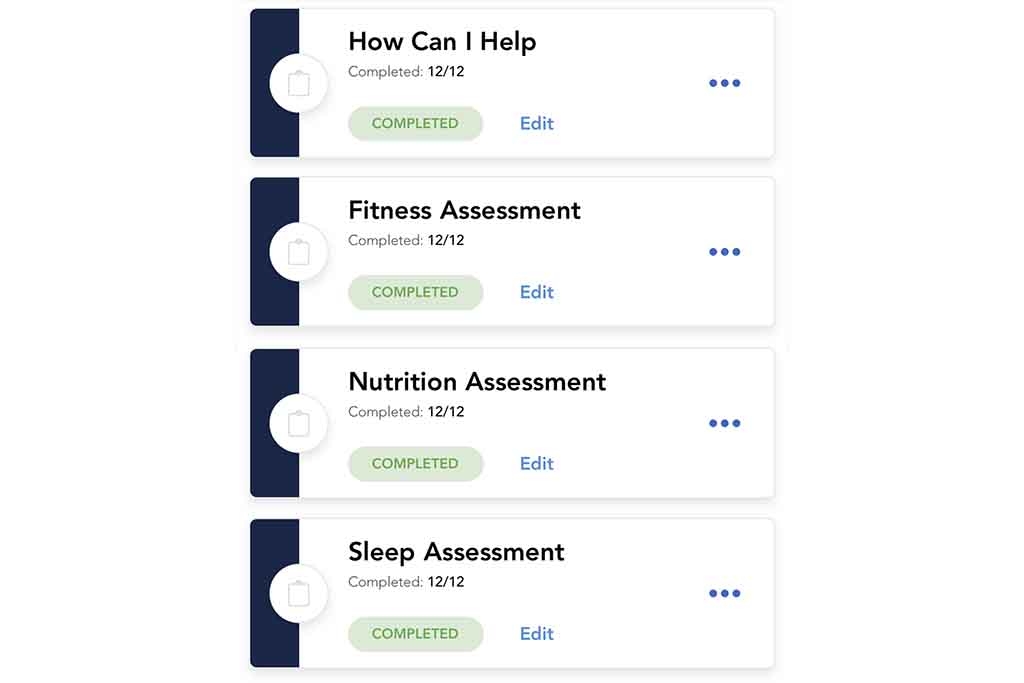

2.

Assess Health

Fill out intake forms detailing your health status and goals.

3.

Connect Virtually

Join the 60-minute coaching session to discuss results and goals.

PRICING

Prices For Services

Whether you’re interested in a one-time consultation or continued coaching, there’s an option for you.

$199

Health Consult

One-time complete health assessment, goal review, and habit planning.

$399

Monthly Coaching

Everything in the health consult plus two coaching sessions a month.

$999

Health Excellence Program

Everything in the health consult plus three months of coaching.

answers to your

FAQs

“Brandon has immense knowledge around nutrition and building healthy habits. Even as a Type 1 diabetic, he provided recipes and guidance that fit my situation. His personalized approach provides benefits well beyond his great YouTube videos. ”

Todd Zerbe

⭐⭐⭐⭐⭐

“I felt like I was living a healthy lifestyle, but I wasn’t getting any results. Then I found out with Brandon that I wasn’t meeting a few key standards. And these were holding me back. Now I’m confident in our plan and I’m already seeing results! Couldn’t be happier.”

Vicki York

⭐⭐⭐⭐⭐