If you’ve completed step 1 in your financial journey of building a proper emergency fund, you’re ready for step 2. This step involves finding out if your company has a 401k, 403b (non-profit), or 457 (government) retirement account. If they do offer one of these retirement accounts, the next step is understanding if they have an employer match.

What is a 401k, 403b or 457?

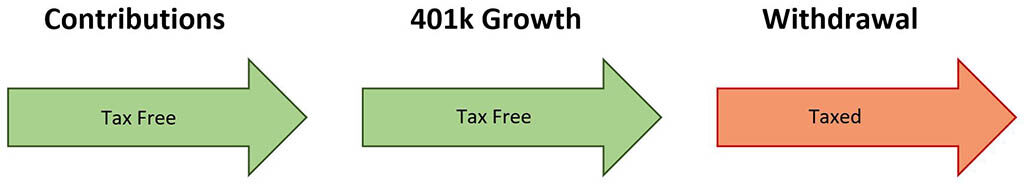

These are traditional retirement accounts sponsored by an employer. Contributions to these accounts come out of your paycheck before taxes are taken out. This not only reduces your taxable income, but the money in your retirement account is allowed to grow tax-free. That means taxes aren’t accrued for any money that your investments make. Money can then be withdrawn penalty free when you turn 59.5 years old. Taxes are applied to any money withdrawn at this point.

There are a few rules and exceptions to what’s listed above. For example, you can withdraw money from these accounts before 59.5 years old but you’ll likely incur a 10% early withdrawal fee unless you qualify for a hardship withdrawal. For all rules and exceptions, refer to the IRS or a financial advisor.

What is an employer match?

A lot of times employers will match your contributions up to a certain point. For example, it’s common for employers to match up to 3% of the employee’s contributions. So, if you’re making $50,000 a year and you contribute 3% of your salary ($1,500), your employer is also contributing $1,500 (3%).

- Salary: $50,000

- Employer Match: 3%

- Employee Contribution: $1,500 (3% of your salary)

- Employer match: $1,500

- Total Contribution: $3,000

If your employer offers this, it’s guaranteed money. And, in today’s world there’s no other investment that’s guaranteed to double your contributions each year. Always contribute the maximum amount that your employer will match. If they match 1%, contribute 1% of your salary. If they match 5%, contribute 5%. Stay tuned for a future post on when you should exceed an employer match.

What’s the most effective way to contribute?

The most effective way to contribute is if you automate your contributions. I always recommend automating your finances because if you don’t, you’re likely to forget or use that money elsewhere. And if you do remember later in the year, you’ll be scrambling to contribute larger lump sums into your account rather than the small automated contributions you could make. Automate your contributions.

- Salary: $50,000

- Yearly Contribution Amount: $1,500

- Employee Pay Periods: 26 (biweekly)

- Automated Contribution: $1,500 / 26 = $57.69

Where should I invest the money?

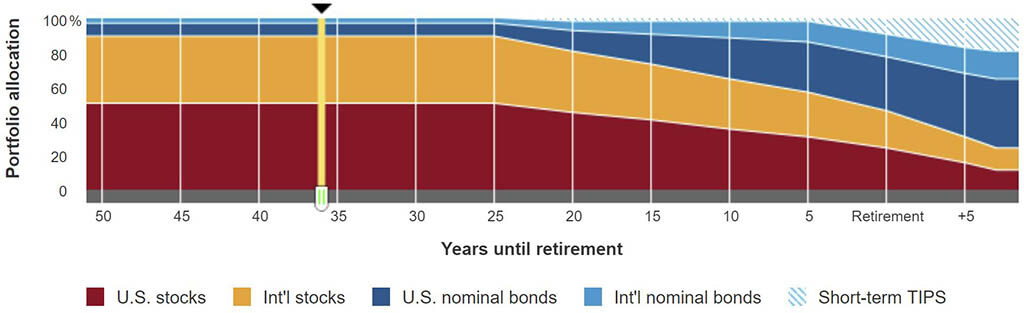

If you’re preparing for a traditional retirement around the age of 60-65, one of the best places to put your money is in a target date fund. With a target date fund, you’ll select a fund that’s geared toward your date of retirement. Then, as you get closer to retirement, your funds will automatically reallocate themselves. For example, when you’re younger it’s recommended to make riskier investments like the stock market. And, when you’re close to retiring, you’ll want to shift to safer investments like bonds. With target date funds, they’ll automatically adjust themselves from riskier to safer investments as you get closer to retirement. This is great because it’s one less thing you have to worry about.

One of my favorite target date funds is through Vanguard. If you follow this link, you can select when you plan on retiring, and they’ll suggest a matching fund. Below, is an example of the fund it recommends to me if I planned on retiring around 60-65.

You’ll have to research the 401k, 403b, or 457 plan that your employer sponsors to see what target date funds they have available. If they have the Vanguard one listed above, great! Invest in that. And automate it so your contributions get automatically invested in your target date fund.

Calculate Your Potential

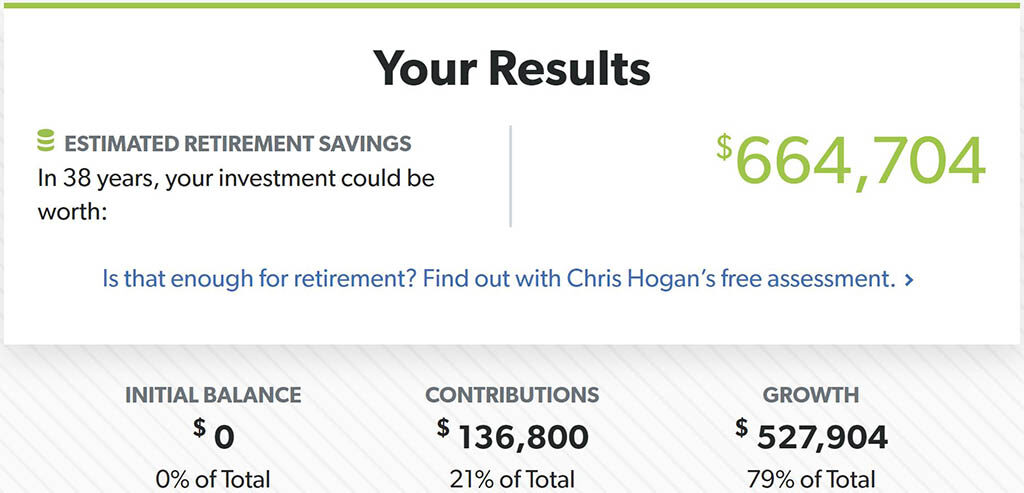

If your employer provides a match, run the numbers for your situation to see how great of an impact it can have. I recommend using this investment calculator for a quick and easy view of your potential. Here’s how the example above will play out for a 27 year old starting today.

- Starting Age: 27

- Retirement Age: 65

- Retirement Account Starting Value: $0.00

- Monthly Contributions: $300 ($150 employee + $150 employer contributions)

- Rate of Return: 7% (average return of a target date fund)

Summary

If you’ve built a proper emergency fund then the next best investment you can make is with your employer sponsored retirement account if they provide an employer match. If that’s the case, always contribute the maximum amount that your employer will match. It’s free money. Automate your contributions with weekly paycheck deductions and send them straight into a target date fund. Even if this is the only money you ever invest with your retirement account, you’ll still be left with a decent retirement fund.

If you liked this post, please subscribe to the weekly newsletter and follow the social media accounts for the latest content!

Disclosure: I frequently review or recommend products and services that I own and use. If you buy these products or services using the links on this site, I receive a small referral commission. This doesn’t impact my review or recommendation.