If you’re on step 4, you’re doing pretty well. You’ve built a proper emergency fund, are receiving an employer match, and have paid off all your debt. Now, you’re ready to start investing in your future. It’s time to open a Roth IRA and max it out. This will provide you with additional emergency funds if you need it, but more importantly, a retirement that’ll make you feel more than comfortable.

What is a Roth IRA?

An IRA is an Individual Retirement Account. It’s not offered through an employer like a 401k but is completely independent. An IRA is a tax-advantaged account that’s meant to be withdrawn from after the age of 59 1/2. There are two main types of IRAs.

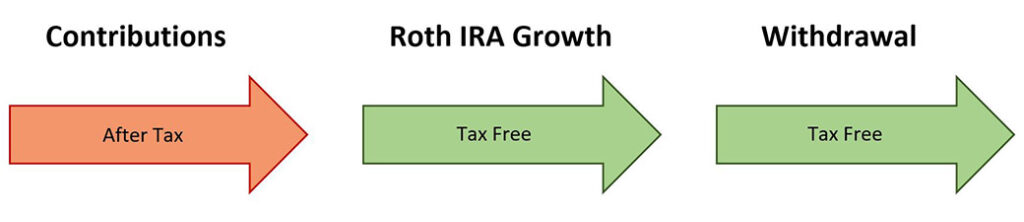

- Traditional: Pre-tax dollars are contributed into the account. The account grows tax-free. And, withdrawals after the age of 59 1/2 are taxable based on your income bracket.

- Roth: After-tax dollars are contributed into the account. The account grows tax-free. And, withdrawals after the age of 59 1/2 are tax-free.

In most cases, a Traditional IRA is slightly better if you plan to be in a lower tax bracket in retirement than you are now. While, a Roth IRA is slightly better if you plan to be in a higher tax bracket in retirement than you are now. But, the differences are small and there are three reasons I recommend a Roth IRA.

- Diversification: Your 401k is typically a Traditional account. So, if you have a Traditional 401k and Roth IRA, you’ve now diversified your tax situation for either scenario in the future.

- Clarity: With a Roth, you’ve already paid all your taxes on the account. That means, when you retire, you can withdraw exactly the amount you have without worrying what taxes are going to be in the future. You know exactly how much money you’ll have and it’s easier to budget.

- Emergency Planning: Although, not recommended, you’re allowed to withdraw any of your contributions (not earnings) from your Roth IRA anytime without penalty. So, if an emergency happens you can pull from this account without any penalties. (Tip: only use as a last resort after you’ve depleted your emergency fund)

Where can I open an account?

There are many different investment companies that allow you to open a Roth IRA. It’s fairly simple and in most cases, free. Below, are three companies I recommend using to open a Roth IRA.

- Fidelity: More traditional investment company with a ton of features, analytics, and investment options. Good customer service. Low fees depending on your investment choice. Good mobile app.

- Vanguard: The main benefit of opening a Vanguard account is being able to then invest your contributions into Vanguard index or mutual funds without any fees. Some of the lowest fees in the market.

- M1 Finance: Smaller start-up company without any fees. Great mobile app. Better for beginners. My favorite choice since it’s free and without fees.

How much should I invest?

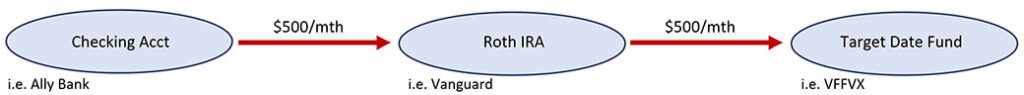

If you have the means, you should invest the maximum allowable contribution. The max in 2019 is $6,000 for everyone below the age of 50 and $7,000 for everyone 50 and above. I recommend taking your maximum allowable contribution and dividing it by 12 to determine a monthly investment plan. For me, that’s $6,000 / 12 = $500/month. Then setup automatic contributions from your checking account into your Roth IRA at the end of each month. Automating the process will keep you on track.

Where should I invest it?

Similar to what I mentioned about investing in a 401k, I recommend people with a Roth IRA invest in a target date fund. With a target date fund, you’ll select a fund that’s geared toward your date of retirement. Then, as you get closer to retirement, your funds will automatically reallocate themselves. For example, when you’re younger it’s recommended to make riskier investments like the stock market. And, when you’re close to retiring, you’ll want to shift to safer investments like bonds. With target date funds, they’ll automatically adjust themselves from riskier to safer investments as you get closer to retirement. This is great because it’s one less thing you have to worry about. One of my favorite target date funds is through Vanguard. If you follow this link, you can select when you plan on retiring, and they’ll suggest a matching fund.

Once you’ve selected the target date fund that suits your needs, you should plan on investing in this fund every month with your automated monthly contribution.

Why should I max out my Roth IRA?

You should prioritize maxing out your Roth IRA because it is your best investment vehicle for retirement. Unlike with a company 401k, you’re allowed to choose which investment company you want to go through. Because of this, you’ll have a lot more options on what to invest in and usually lower fees, which means higher returns. And, $500 a month really adds up.

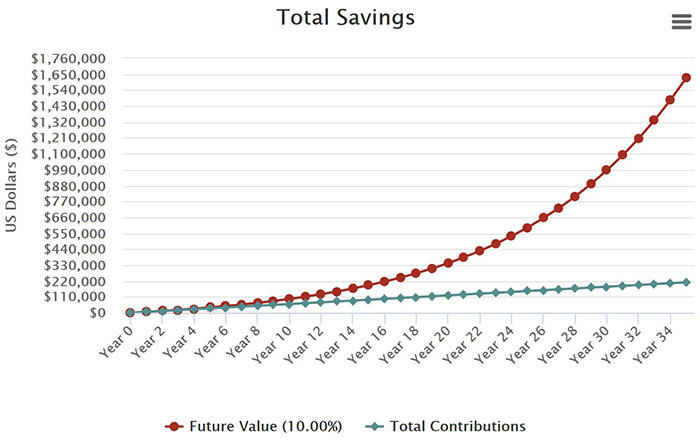

Below, is an example of how your Roth IRA could grow. This example assumes you invested $500 per month into a target date fund that grew at a 10% rate for 35 years. If you were able to accomplish this, you’d have over $1.5 million saved! And the best part is, you’d only contribute $210,000 in total while the target date fund and compound interest did the rest of the work.

I’m 27 years old now and I’ve made it a point to invest the maximum amount for the past 6 years. This means I’ve contributed a total of $33,000 towards my retirement and it’s grown to $53,000! That’s $20,000 in earnings from using the strategy I’ve mentioned in this article. If I keep this up, there’s no doubt my Roth IRA will one day near $2 million.

Summary

If you want to set yourself up for a comfortable retirement, maxing out your Roth IRA will get you there. I’ve found it best to automate the process and keep it simple. Setup automatic $500 payments to go from your checking account to your Roth IRA. Then invest that full amount into a target date fund. Repeat this process each month until retirement and you’ll be set!

If you liked this post, please subscribe to the weekly newsletter and follow the social media accounts for the latest content!

Disclosure: I frequently review or recommend products and services that I own and use. If you buy these products or services using the links on this site, I receive a small referral commission. This doesn’t impact my review or recommendation.