Ever since watching Jim Cramer’s TV show Mad Money in high school, I’ve had an interest in investing. He always talked about how to evaluate the stock market, how to tell when it’s a bull vs bear market, and when to buy/sell. This was super interesting to me and when I finally got my first job after college, I opened a Roth IRA (individual retirement account) and started investing. I picked a handful of diversified stocks and bought when Jim indicated it was an appropriate time. This worked well but over the years, as I learned more about investing, I realized there was a better strategy. Instead of stressing about when I should buy or sell stocks, I found a strategy that helped me automate the process and alleviate the stress. And instead of spending hours each month researching the best time to buy and sell, I found an effortless strategy that produced an equal, if not better return on investment. Below, are three lessons I’ve learned about when to invest which have saved me tons of time, stress, and money.

Lesson 1: Market Timing is Impossible Longterm

Whether investing in a 401k, IRA or brokerage account, a lot of people get caught up in the buy/sell moments. They scour the internet for research on if it’s an appropriate time to buy or sell. A lot of people even buy products that send alerts when it’s time to buy or sell using charts like the one shown below. The problem with this is that the stock market is highly unpredictable. Although the market trends upwards from a long-term yearly perspective, no one can consistently tell whether it’ll rise or drop tomorrow, or next week, or next month. No one, no algorithm and no program can predict it in the short-term.

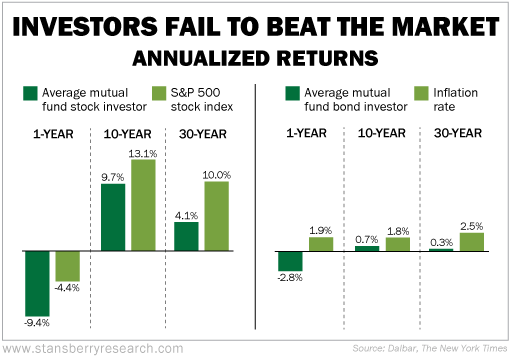

Even though no one can determine whether the market will rise or drop in the short term, there are many people who attempt to predict it. There are also people who get college degrees for their studies on finance and the stock market. These same people will even go on to professional careers in the investment sector and spend their whole life trying to understand and predict the market. These same people start mutual funds where they buy and sell stocks based on their extensive knowledge and experience of the market and they too fail to understand when the appropriate time to buy and sell is. For example, the chart below shows the performance of an average mutual fund stock investor vs the S&P 500. A mutual fund stock investor is a professional trying to time the market by buying and selling stocks based on his knowledge and experience. The S&P 500 is a collection of the 500 largest publicly traded companies in the United States and is a good representation of the entire stock market.

From this chart we can see that even the professionals produce a rate of return significantly lower than if they just would’ve invested in the market as a whole (or the S&P 500). One of the reasons for this lower performance is that the investor trying to determine when to buy and sell, needs to be correct twice. They need to correctly guess when to buy, but also when to sell. And with the market being so unpredictable in the short term, the likelihood of someone making the correct decision twice is unlikely. And the likelihood of them making these decisions correctly for an extended period is even more unlikely. That’s why if you take any professional investor and compare their returns vs the market, they perform consistently worse as the time increases from years to decades.

Based on this information and the hundreds of studies backing it up, I’ve learned that it’d be stupid for me to think I have the ability to determine when the market will rise or fall in the short term even if I’m following the advice from professionals. Therefore, I’ll never be able to determine when the best time to buy or sell is. And if I can’t predict when I should buy or sell, how do I determine when I do buy or sell?

Lesson 2: Lump Sum Investing is Likely Best

If I have money that I’ve decided I want to invest, I invest it immediately. I don’t look at how the market has performed yesterday, or last week, or last month. I don’t consider what market analysts predict the market will do tomorrow, or next month, or next year. I don’t read the news, or assess my own feelings, or do anything at all. If I have money that I’ve decided to invest, I invest it immediately.

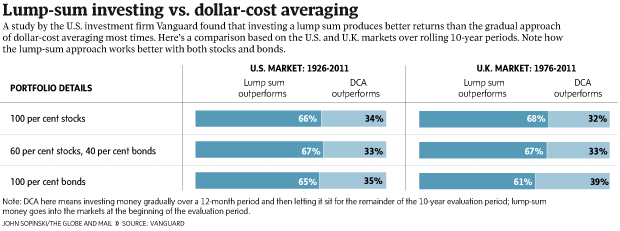

This is an example of lump-sum investing. Lump-sum investing means that you immediately invest all your declared money at once (in a lump-sum). In a study published around 2011, we can see how lump-sum investing has fared against dollar-cost averaging which is another good and recommended strategy I’ll mention soon. According to this study, lump-sum investing beats dollar-cost averaging about 65% of the time. This holds true whether investing in stocks, bonds, or a blended portfolio. It also holds true whether investing in the US market or UK market. There are several other studies backing this up as well. Most of the time, lump-sum investing will beat dollar-cost averaging. And both strategies are proven to beat market timing.

Therefore, I’ve determined that lump-sum investing is my best bet for achieving the highest return on investment. This can be useful anytime I have a sum of money that I want to invest. I’ve found this useful when I get a bonus at work, my yearly tax return, or cash from selling expensive items on Craigslist. Anytime I have a lump sum of money that I want to invest, I invest it immediately. This all boils down to the fact that the stock market trends upwards over a long-term yearly perspective, but is completely unpredictable day-to-day, week-to-week, or year-to-year. And that time in the market, beats timing the market. The sooner your money is invested, the more opportunity it’ll have to grow and reap the long-term rewards.

But what if I don’t have a lump sum of money available to invest like a bonus, tax return, or recent cash influx? What’s the next best option?

Lesson 3: Dollar-Cost Averaging is Most Recommended

The next best option I’ve found is dollar-cost averaging. Dollar-cost averaging is investing money into the market on a set schedule not to be deviated. For example, if I want to hit the $6,000 IRA contribution limit this year but I don’t have $6,000 right now to invest in a lump-sum, then I may setup a fixed schedule. For example, I know I can accumulate $500 each month from my job that I can then contribute into my IRA. That allows me to setup a schedule for automatic investing. Below, you can see a schedule I’ve setup to invest into the market on a fixed schedule to reach my IRA contribution limit/goal. On the first of each month, I invest $500. I continue this for the entire year without any consideration of stock market performance or analyst predictions.

| Investment Date | Investment Amount |

|---|---|

| January 1st | $500 |

| February 1st | $500 |

| March 1st | $500 |

| April 1st | $500 |

Most people already use this strategy unknowingly with their 401k contributions. For each paycheck they receive, part of it automatically gets invested in their retirement account. This usually happens on a set schedule depending in if you’re paid weekly, biweekly, or monthly. This is an example of dollar-cost averaging. This strategy is effective because you’re consistently investing during the market’s highs and lows. There is no emotion involved or opportunity to time the market. It’s an investment strategy built off the idea that time in the market beats timing the market. The sooner you can get your money into the stock market, the more opportunity you have to ride the long-term upward trend. I’ve found this investment strategy useful for investing the money I consistently earn at my job. It’s a terrific way to get my money in the market as soon as it’s available in an automated, scheduled fashion. This affords me the best return on investment without the stress, effort or worry about when to buy or sell.

Reminder for All Investing

Investments into the stock market should only be made with money not needed within 5 years. Within 5 years, I’ve found it best to keep my money in a high-yield savings account. Also, as noted in my seven steps to financial freedom, investing shouldn’t really be considered until you’ve become debt free.

Final Thoughts

Investing in the stock market is a sound idea for long-term financial success. But the opportunity can cause people to become greedy and seek a higher return on investment than history has shown possible. This triggers people to buy and sell investments based on stock market charts, analyst recommendations and personal feelings. All of this has been proven to cause a lower return on investment than the latter two options outlined above. If you have money now that you want to invest, then invest it immediately in one lump-sum. If you don’t have the money now but will be getting it consistently in the future, setup a fixed investment schedule. Both strategies build on the fact that the market trends upward in the long-term but is unpredictable in the short-term. It also builds on the idea that time in the market beats timing the market. So, invest wisely, and use these proven approaches for your best rate of return.

If you liked this post, please subscribe to the weekly newsletter and follow the social media accounts for the latest content!

Hey, I am Brandon Zerbe

Welcome to myHealthSciences! My goal has always been to increase quality-of-life with healthy habits that are sustainable, efficient and effective. I do this by covering topics like Fitness, Nutrition, Sleep, Cognitive Health, Financial Independence and Minimalism. You can read more about me here.

Sources:

- Buy The Dip (BTD) – To Buy Or Not To Buy

- Jack Bogle Explains How the Index Fund Won with Investors

- The Lump Sum vs. Dollar Cost Averaging Decision

- Which is Better: Lump-Sum Investing or Dollar-Cost Averaging?

- The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns (Little Books. Big Profits)

Disclosure: I frequently review or recommend products and services that I own and use. If you buy these products or services using the links on this site, I receive a small referral commission. This doesn’t impact my review or recommendation.