Am I buying a house?! No, not yet. Am I looking into buying a house? Still no. But am I considering how I would buy a house if I wanted to buy a house? Absolutely! As I’m on the verge of turning 29 this month, and edging closer to house purchasing age, I’ve been researching and listening to many people talk about mortgages. I’ve heard questions like, “How much house can I afford?” which seems like a dangerous question to begin with. I’ve seen information online saying a 30-year mortgage is the American standard and should be selected by all. And I’ve seen opposing advice from Dave Ramsey, one of the most popular personal finance advisors, who only recommends a 15-year mortgage for everyone. So, after taking in all this information, I decided to dig in myself and see what I could find. Here’s what I found out.

The Case for A 15-Year Mortgage

With a 15-year mortgage, you make monthly payments towards your house and pay it off completely within 15 years. That’s only 180 payments before you own your house completely. Twice as fast as a 30-year mortgage. By choosing this route, not only do you pay off the mortgage twice as fast, but banks will almost always reward you with a lower interest rate. This means you pay less money to the bank in interest and keep more money in your pocket. That’s two quick wins right there. You completely own your home in half the time, and you pay a lower, better interest rate.

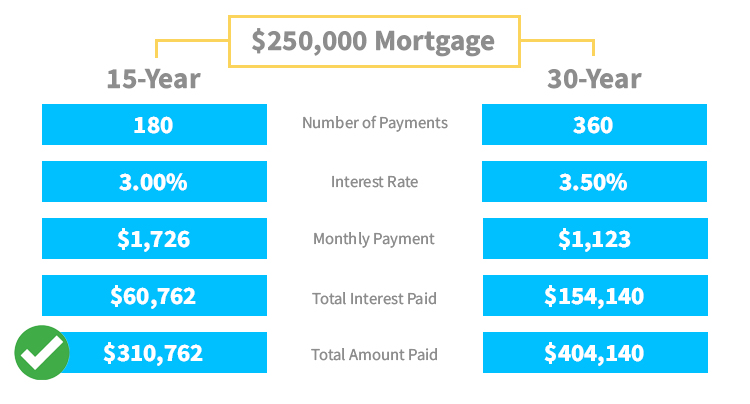

What does this mean? With the shorter length of the mortgage, and the lower interest rate, you end up paying significantly less for the house. For example, after completing 15 years of payments on a $250,000 mortgage, you’ve also paid over $60,000 in interest. This means you’ve paid about $310,000 total to purchase your house. If you compare that to a 30-year mortgage on the same house, the 30-year mortgage ends up accumulating $154,000 in interest totaling $404,000 total. That’s almost $100,000 more that you’ve paid to own the same house.

So, a 15-year mortgage is the winner, right?

The Case for A 30-Year Mortgage

The issue with the argument above is that you’re not taking into consideration the opportunity cost. For example, with a 30-year mortgage, your monthly payment will be reduced. In this example of a $250,000 mortgage, a 30-year mortgage will provide you with a $1,123 monthly payment compared to $1,726 for a 15-year mortgage. That means you’re saving $603 per month with a 30-year mortgage. That’s a good amount of money extra each month that you’ll have in your pocket.

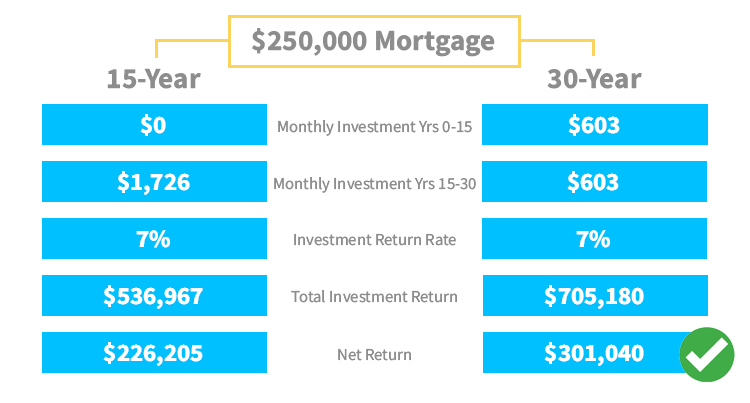

Now say you take that $603 per month that you’re saving on a 30-year mortgage and invest it into the stock market (could be using your retirement or brokerage account). If you make a 7% return on that investment, which the stock market has historically returned, you’ll end up with $705,180 after 30 years. You take that investment total, minus how much you paid in total for the house ($404,140 shown above), and you end up with a net return of $301,000. Rather good. You came out well ahead.

Let’s compare that to the 15-year mortgage. With a 15-year mortgage, you don’t have any extra money to invest for the first 15 years. But, once the house is completely paid off after 15 years, you can now invest the entire monthly amount. That means, for the 15 years after you’ve paid off your house, you can invest $1,726 each month into the stock market. With a 7% rate of return, your investment will total $537,000. If you take that investment total, minus how much you paid in total for the house ($310,762 shown above), you end up with a net return of only $226,205. That’s less than the 30-year mortgage.

By running the numbers and comparing the 15- vs 30-year mortgages with opportunity costs included, you’ll end up with about $75,000 more in your pocket after 30 years. Mathematically, this would make the 30-year mortgage a better choice financially, correct?

What You Should Choose

Not so fast. Now that we understand the mathematical side of it, let’s take into consideration the psychological side which may be much more important. First, having your house paid off in 15 years vs 30 years relieves a lot of mental stress. Knowing you own your home in full, and that no one can take it away from you, brings an extraordinary amount of peace of mind. Based on others pursuits, I’ve seen very few people regret paying their home off in 15 years and most are incredibly happy with the accomplishment. Second, the higher monthly payment associated with the 15-year mortgage helps you stay within budget. By purchasing a home that you can afford to pay off in 15 years, you mitigate the risks of overextending yourself and letting the house own you rather than you owning the house. And third, nearly everyone who chooses a 30-year mortgage will not take full advantage of the opportunity costs available. This means those with a 30-year mortgage are more likely to spend that extra money saved on the monthly payment rather than investing the remainder.

Therefore, I’ve found that a 15-year mortgage is the correct choice for 95% of home buyers. Don’t fool yourself into thinking that you’re the type of person who will invest the money saved on a lower monthly payment. You likely won’t. Don’t fool yourself into thinking that a 30-year mortgage will allow you to buy your forever home and increase your happiness. Hedonic adaptation will happen, and you’ll soon be dreaming of an ever bigger, better home. And don’t fool yourself into thinking you deserve the most house a bank will give you. This will lead to a house owning you, and you not owning a house. That’s why I prefer the 15-year mortgage for almost everyone. You’ll stay within budget, pay it off twice as fast, and have much more peace of mind.

(95% of People) A 15-Year Mortgage Fits You if:

With that being said, I do think there are cases for people to get a 30-year mortgage. Statistics would say it’s probably not you, but here are some of the cases. If you’ve proven to yourself that you’re a disciplined saver and savvy investor that can take advantage of the opportunity costs, you could end up financially ahead with a 30-year mortgage. This would mean continually investing the monthly payment saved with a 30-year mortgage into the stock market and it could lead to some great gains. Another case for a 30-year mortgage would be people wanting to use the extra money to start a business or invest in real estate. These entrepreneurial endeavors could return more than the stock market when done successfully. Although it’s difficult, this route can not only be rewarding financially, but can be a fantastic opportunity to learn and grow as a person. If you have an entrepreneurial mindset and see yourself taking this route, I can see a 30-year mortgage being appropriate for you too. With those points in mind, I limit myself to recommending a 30-year mortgage about 5% of people that fit the following criteria.

(5% of People) A 30-Year Mortgage Fits You if:

With those two options available I did want to add a few notes that I thought would be helpful.

Note 1: I used a fixed interest rate for all my calculations. This appears to be the correct choice for 99% of people applying for a mortgage compared to an adjustable rate.

Note 2: With either a 15-year or 30-year mortgage, I recommend saving up a 20% down payment. This alleviates you from paying for PMI (Private Mortgage Insurance) which is an extra monthly fee you’ll pay to insure you don’t default on the house.

Note 3: Most people think rent is like throwing away money. It’s not! Renting is a good option too! Financially, it makes more sense to rent unless you plan on living in the same house for at least 7 years due to the transaction costs of buying and selling a home. So, don’t hate rent-life. Many people are doing well, including me, by renting.

Final Thoughts

Buying a home is a big decision and a fun one! But don’t let your wildest dreams overshadow your financial reality. Getting a fixed-rate 15-year mortgage will help ensure you’re buying a house within your budget. You’ll also get it paid off twice as fast and save thousands of dollars in interest compared to a 30-year mortgage. As soon as you know it, you’ll own your house in full and have so much more peace of mind. But if you’re one of the few super saver, investor savvy, entrepreneurial minded individuals, then a 30-year mortgage may help get you ahead and open new opportunities down the road. So, no matter your decision, make a good, smart choice and enjoy your new home!

Have you received your free health kit that includes a mobility workout and whole foods recipe?

Hey, I am Brandon Zerbe

Welcome to myHealthSciences! My goal has always been to increase quality-of-life with healthy habits that are sustainable, efficient, and effective. I do this by covering topics like Fitness, Nutrition, Sleep, Cognition, Finance and Minimalism. You can read more about me here.