The other week my employer’s financial advisor held a retirement training session for all the employees. His goal was to describe the investment options available to us through our organization’s 403b plan (a 401k for non-profits). In doing so, he made a broad recommendation that the best investment option for all employees was a target date fund. And I thought about this and was like he’s not wrong… but he’s also not right. This may be the best option for employees who are new to investing or want a set-it-and-forget-it option, which is most people I’d say, but there was something here that made me cringe just a little bit. Normally I’m all about target date funds if they’re low-cost. But our target date fund options aren’t. And if you’re willing to spend 1 hour per year reviewing your investment portfolio, you could easily save an extra $100,000 by retirement.

Obviously, I couldn’t speak up in this situation. I’m not a financial advisor, I can’t and don’t give investment advice, and his recommendations were well intentioned for the audience. But for me, who somewhat understands our investment options, I couldn’t help but think about how many people may be squandering thousands of dollars over their lifetime. And so, what else could I do but blog about it? So today I’m going to detail how I made my 403b investment choices and why I think it’s going to save me $100,000 more than the financial advisor’s recommendation.

Disclaimer: I’m just a dude writing blog posts from his bedroom on a Friday night 😎 Please do your own investment research and come to your own conclusions 🤓 I know nothing 🙂

Quick Definitions

Let’s start off with some quick definitions that I think will help with my analysis and story.

So now that we have a grasp of what’s going on here, I’m going to detail how I’ve decided to pick the mutual funds in my 403b retirement account to optimize my returns. Aka, make the most dough. 💰

Target Date Funds

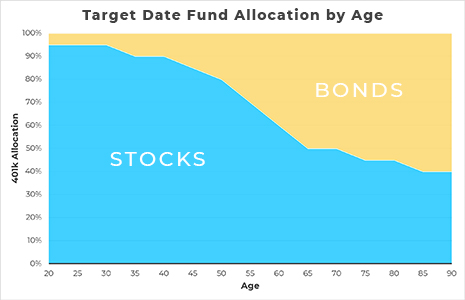

These are a type of mutual fund that in their simplest form, are a mix of stocks and bonds. And as you get closer to retirement, the target date fund will start shifting more of your investments from the higher risk higher reward stocks, to the lower risk lower reward bonds. And it does this reallocation automatically depending on when you want to retire. And this is great for many situations. I actually like target date funds a lot when the cost is right (below ~.25%). They are the set-it-and-forget-it investment option that manages your risk automatically as you get closer to retirement.

But during the financial meeting I mentioned earlier, there were two reasons that made me cringe when our advisor recommended these target date funds to everyone:

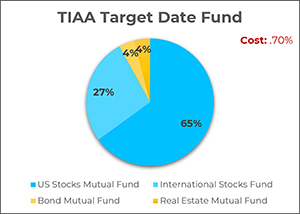

- The target date funds available in our 403b have a net expense ratio of .70%. This is high! It costs us a lot to use these target date funds, and this was never mentioned during our meeting.

- Our target date funds are offered by the same institution that offers our 403b account. This isn’t bad but it always makes me pause when someone is recommending their own product. Could there be a conflict of interest here? Are they only recommending their own product because it benefits them the most? Would they even tell us if the best products for us aren’t their own products?

And that first reason is why I decided not to use a target date fund for my 403b account, and that second reason is what compelled me to blog about it. 😅

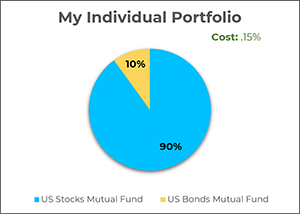

Selecting 401k/403b/457 Mutual Funds

So, here’s what I did instead. I sort of bought the equivalent of what’s already in a target date fund but separately. For example, I bought a low-cost mutual fund that mimics the US stock market. I then bought a low-cost mutual fund that mimics the US bond market. And then I just allocated 90% of my investments into the stocks and 10% into the bonds just as a target date fund would do automatically. And the net expense ratios of my two funds were .16% and .05% respectively. Much cheaper than the target date funds .70%!

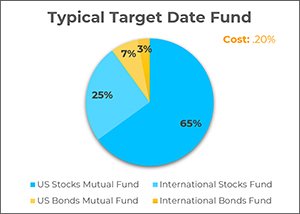

And as you can see from the images above, my custom portfolio is nearly identical to the typical target date fund and the TIAA target date fund that’s available in my 403b account. Now there are a few differences, so I’ll mention those real quick:

- I decided not to have exposure to international stocks or bonds. These have historically been outperformed by the United States stocks and bonds and are considered optional by most. Also, the international mutual funds made available to us have net expense ratios of around .85% (expensive).

- The benefit of a target date fund is it rebalances itself automatically to match how close you are to retirement (stocks vs bonds). But with my custom portfolio, I must spend about an hour each year rebalancing my stock vs bond ratio. Honestly, this could be done in like 15 minutes per year, but I usually get distracted by the fancy performance charts.

To sum it up, I just recreated the typical target date fund without international exposure because it was expensive and unnecessary. I then just rebalance my portfolio each year. So, simple stuff here. But how does this pay off?

Overall Return

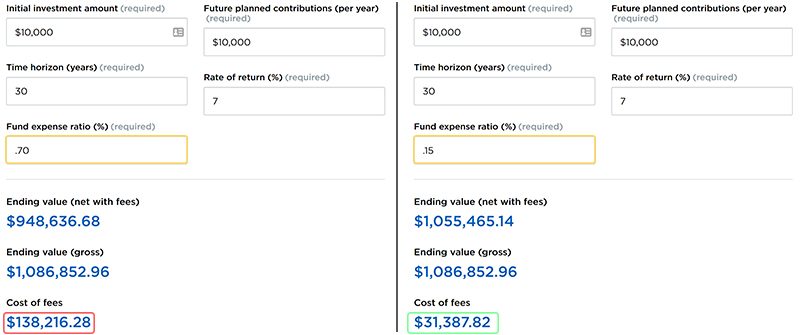

How does my average .15% net expense ratio compare to the .70% recommended by my financial advisor? Well let’s math it out real quick! Let’s say you’re contributing $10,000 per year to your 401k account for 30 years. And since my portfolio is essentially the same as the target date fund, we’ll assume they both produce a 7% rate of return which is common. After 30 years, here’s what we got:

In both scenarios, we invested the same amount of money and grew it to the same ending value of $1,086,852. Wow, we’re millionaires! Great. But wait, we still must pay the fees that the mutual funds are charging us (the net expense ratios). With the TIAA target date fund at .70%, our fees total $138,000! And you probably thought .70% wasn’t anything at all until we mathed it out. Compare that to only $31,000 from my custom portfolio. So, let’s get this straight. All I’m doing is spending 1 hour per year rebalancing my portfolio for 30 years to save on the expense fees. In the end, I’ve saved $106,828 for 30 hours of work. That’s $3,560 per hour. Yea, umm… I don’t mind giving up one hour per year at that rate. Not at all. I shall balance my own portfolio, Mr. Financial Advisor.

Final Thoughts

Now, I know this approach isn’t for everyone. And I understand the investment options offered in your 401k/403b/457 are likely different than mine. But this approach of not accepting the default and peeling back the curtains to understand what’s going on is something that can pay dividends. Literally. And by not accepting our financial advisors default target date fund recommendation and selecting my own investments that mimic that mutual fund, I’ve found a way that will save me more than $100,000 by the time I’m 60. All for about 30 hours of work. To me, that sounds like a healthier and happier life.

Want to jumpstart your health journey with a free workout, recipe, and sleep tips?

Watch a YouTube Video Summarizing the Post

Hey, I am Brandon Zerbe

Welcome to myHealthSciences! My goal has always been to increase quality-of-life with healthy habits that are sustainable, efficient, and effective. I do this by covering topics like Fitness, Nutrition, Sleep, Cognition, Finance and Minimalism. You can read more about me here.

Sources:

- TIAA-CREF Lifecycle 2055 Fund – This is the high-cost target date fund made available through my 403b.

- Vanguard Target Retirement 2055 Fund – This is a low-cost target date fund that I wish was available.

- State Street S&P 500 Index Fund – This is the US stock market fund I invested in. Technically it’s not the total stock market but the top 500 companies. Which historically have mirrored the total stock market’s returns.

- Vanguard Total Bond Market Index Fund – This is the total US bond market fund I invested in.

- Mutual Fund Calculator: Find What Fees Will Cost You