Ever since being $150,000 in debt from student loans, I’ve been on a mission to continually learn more about finance and give myself the opportunity to achieve FIRE. Financially Independent Retiring Early; which translates to, living off of your investments without the need for a full-time job or consistent income, well before the age of 65. I’m 27 now and looking to achieve FIRE by 40. Each month I’ll continue to share my journey of financial moves and lessons learned in order to accomplish this goal.

Monthly Expense Review

Each month I’ve found it extremely useful to review all my expenses for the previous month. Since I put everything on the two credit cards listed below, besides rent and electric, this makes it fairly easy to review. It’s best practice to perform this review every month to find subscriptions you’re no longer using, charges you may not have made, and to understand your spending habits. Below, are my April expenses.

American Express Credit Card (-$501)

I only use my American Express credit card for groceries. With a 6% cash back bonus on groceries, there’s no card on the market that beats this. I highly recommend applying for one of these cards solely for grocery use. With that said, my grocery bill was slightly higher than usual but I’m hoping to lower it as nicer weather approaches, and the local farmer’s market becomes more appealing.

If you’re interested in receiving 6% cash back on groceries and a qualifying $250 sign-up bonus, here’s a link.

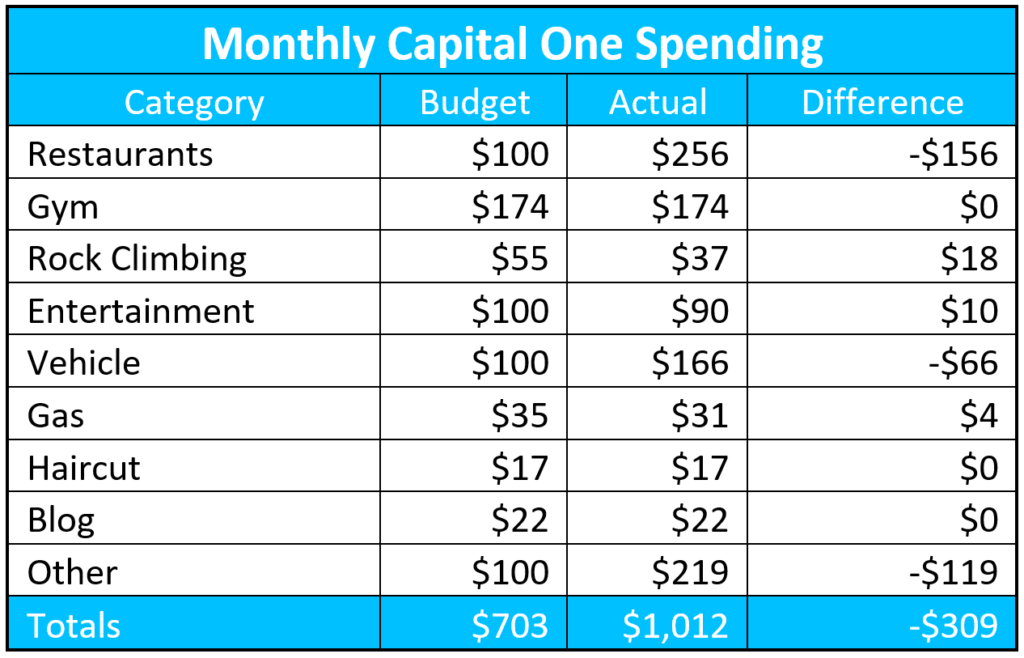

Capital One Credit Card (-$1,012)

I use my Capital One credit card for any remaining purchases. At 1.5% cash back on all purchases, there’s not many better cards out there. Here’s how my remaining monthly expenses panned out:

Definitely went over budget this month. I really need to cut back on eating out and stick to the healthier, cheaper, home-cooked meals.

If you’re interested in receiving 1.5% cash back on all purchases and a $150 sign-up bonus, here is a link to the Capital One card I use.

Correct Order for Investing Your Money

I recently discovered a blogger called My Money Wizard who provides some great content. What I’ve found most useful on his site is an article called The Correct Order for Investing Your Money. I’ve found this article to be invaluable no matter who you are. It’s quite easy to follow as everyone has heard of, and should have started with step one (building up an emergency fund). After that, you just follow the path onto steps two, three, and beyond. It’s a great way to start planning for financial independence and I tend to review this article every few months to keep me on track.

If you’re new to saving and investing, it’s a great article to get you started.

Interesting Ted Talk

Here’s a really interesting Ted talk I watched this past month called “Why you should think about financial independence and mini-retirements.” Although I think what she describes is fairly hard to achieve, it’s certainly possible and has inspired me to create this blog. It’s also a new way to think about retirement. Instead of being retired at the end of your life, you break up those retirement years and spread them throughout your life. If nothing else, it’s an interesting approach.

Summary

Annnd that is the completion of the first monthly financial health update. I definitely spent more money than I was planning to this month but that’s life sometimes.

Putting together this blog post forced me to go into each account and perform a monthly audit. This alone provides a ton of insight into your finances and gives you a better understanding of where all your money is going. It’s great way to understand your spending habits and plan for your future goals.

If you liked this post, please subscribe to the weekly newsletter or follow the social media accounts for the latest content!