A couple of weeks ago I was looking over a list of the top cryptocurrencies by market capitalization when I saw a coin called Shiba Inu. It had just broken into the top 20 largest cryptocurrencies on earth out of the thousands that exist. And I was so confused because Shiba Inu is the breed of dog that mascots the cryptocurrency Dogecoin. And Dogecoin is a joke cryptocurrency that was made to counter Bitcoin. And if you have no clue what I’m saying, we’re on the same page. Bitcoin is the largest cryptocurrency, or digital currency, on earth. A joke cryptocurrency, or digital currency, was created to rival Bitcoin called Dogecoin. And then another joke cryptocurrency, Shiba Inu, was created to rival the current joke currency Dogecoin. To summarize, we have a joke coin created after a joke coin created after a “real” coin. And somehow, people had piled over 13 billion dollars into the joke of a joke coin. And it was at this time I knew I finally had to cover what cryptocurrency is, my thoughts on the space, whether it’s worth investing in, and detail all the cryptocurrency trades I’ve ever made. So, let’s get into it!

What is a Cryptocurrency? (Bitcoin, Ethereum, etc.)

A cryptocurrency is a form of digital money. And there are numerous different cryptocurrencies (Bitcoin, Ethereum, Dogecoin, etc.) just like there are numerous fiat currencies like the U.S. Dollar, British Pound, or European Euro. But unlike the Dollar, Pound, or Euro, cryptocurrencies aren’t backed by a government and don’t have printed bills or physical coins. Everything is digital and there is no one backing it like the government or gold. This means that the value of a cryptocurrency is set completely based upon how much someone else is willing to pay for it. It’s really supply and demand without any support. And this is what makes the value of a cryptocurrency so volatile. If everyone believes a Bitcoin is valuable, the price will rise. If everyone believes a Bitcoin isn’t valuable, the price will drop.

Now there are many reasons why people believe cryptocurrencies are valuable which raise their price. Some people believe cryptocurrencies will replace fiat currencies like the U.S. dollar for everything. That you’ll be getting paid your weekly wages in Bitcoin or buying your groceries with Ethereum. Others think that cryptocurrencies are a store of value. So instead of keeping your money in a savings account, which has a low interest rate that doesn’t match inflation, cryptocurrencies may offer a more lucrative way of saving your money that beats inflation. And there are many other reasons like privacy and security that have people believing cryptocurrency is the future. All these reasons drive the price of cryptocurrencies upwards. But, at the same time, these cryptocurrencies are new, not backed by a government or gold, could be made illegal at any time, and have little regulation or day-to-day use currently which can drive the price down. And this is why the price of each cryptocurrency is so volatile.

To Buy or Not To Buy

Now if you were to listen to much of the online community, new age investors, or Elon Musk, then you’re confident that one or several of the current cryptocurrencies are the future and that the price is going to the moon. The value of these currencies is only going to increase so buy in now and watch your fortune turn into tendies allowing you to quit your job and retire early. On the other hand, some of the most successful investors of all time, the older age investors are saying that these cryptocurrencies are worthless, mostly used for illegal activities, and are just a hustle. Eventually, when everyone realizes that they’re worthless then the price is going to zero and the average crypto investor will have lost their entire investment. But the truth is, no one has any idea what is going to happen in the cryptocurrency space. No one knows if any of the current cryptocurrencies will survive in the next ten years or if they’ll completely take over the global market. No one knows if everything is crashing or 10xing tomorrow. It’s all a guess. And everyone has their own opinions but there’s no long-term data that can be used to predict the future. And most of the average investors today are solely investing in cryptocurrency because of the news, headlines, and get-rich-quick opportunity.

But here are my thoughts. First, I’m not a financial advisor, I don’t know any more about crypto than anyone else on the internet, and I have no idea if crypto is the future or not. I’m guessing. Or in other words, gambling. I have no idea. But I did make cryptocurrency purchases in 2019 and throughout 2020 because I believed it was an asymmetrical bet. For example, I bought into Bitcoin when it was priced around $9,000 compared to its high point of $65,000 a few weeks ago. At the time of my purchases, I thought there was a 50% chance my investments would go to zero. But I also thought there was a 50% chance that it could 10x and be the future. And so, my small $5,000 investment into the cryptocurrency space was worth the risk to me. I’d be fine if it went to zero because the reward was worth the risk to me. Now, the odds I just laid out, this asymmetrical bet that I made where the upside far exceeded the downside, was still just my opinion. I was guessing at those numbers with no knowledge to make accurate guesses, but it seemed worth the risk to me.

But I never would’ve made this asymmetrical bet if I hadn’t been standing on a strong financial foundation to begin with. One where I had paid off all outstanding debt, had a proper emergency fund, and maxed out my retirement and health savings account. Only after doing all the proven methods of generating long-term wealth did I decide that throwing 3-5% of my total portfolio in cryptocurrency could provide more diversification and calculated risk.

All My Trades

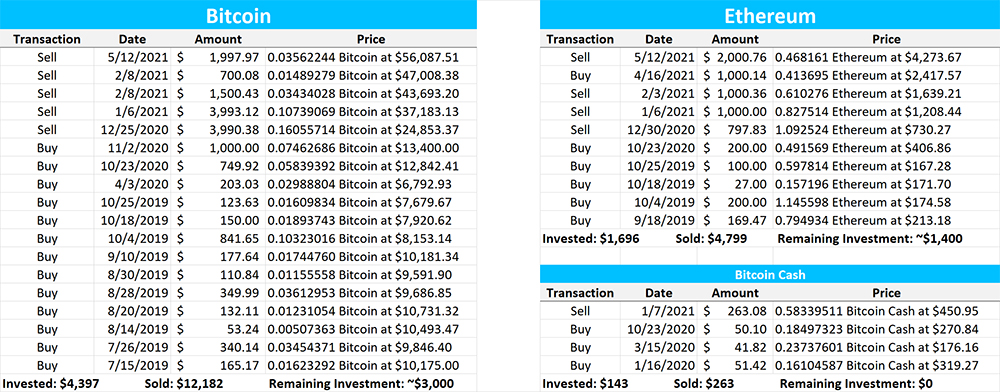

Now, after I had a solid foundation that included an emergency fund, Roth IRA, 401k, and HSA, did I decide to throw some money into Bitcoin and Ethereum. These have been the two largest and most well-established cryptocurrencies for years now. And I did this using an app called Robinhood, where you don’t technically own the actual cryptocurrency coins but that’s another story. So, I thought I’d list every trade I’ve made and summarize a few points.

With all the hype in recent months I no longer see cryptocurrency as that same asymmetrical bet that I once did which is why I’ve reduced my investment even more recently. But again, this is a total guess. I have no idea what’s going to happen with cryptocurrency and by no means do I believe I know more than the thousands of Harvard graduate degrees out there running prediction algorithms on supercomputers much more complex than the limitations of my tiny brain. So, I still have some money invested in cryptocurrency that I plan to maintain for the long-term but it’s below 5% of my portfolio. And instead, I’ve been investing much more heavily in the best investment vehicle available today… an index fund that mirrors the United States stock market. (e.g. VTI)

Final Thoughts

I’m not a financial advisor and this isn’t financial advice. I’m a bedroom blogger sharing my short trip to the moon. And I have no idea if cryptocurrency is a worthwhile investment or not. And neither does anyone else. But after I’ve maxed out the tried-and-true personal finance investment vehicles like an IRA, 401k, and HSA, then I think a small bet into cryptocurrency that’s less than 5% of my total portfolio is worth the gamble. I’m making these gambles knowing that my crypto investment could go to zero at any point and I’ll be fine. And I’m doing so with a long-term mindset where I don’t plan on making daily or monthly trades. But lately, with cryptocurrency being so hot, I’ve took some profits, lowered my risk appetite, and continued investing in the U.S. stock market. And no matter what happens with crypto, I think this strategy will set me up for a healthier and happier life.

Want a weekly update on the 3 most important things I’ve read, watched, and listened to within the past week that include my future thoughts and trades in crypto?

Watch a YouTube Video Summarizing the Post

Hey, I am Brandon Zerbe

Welcome to myHealthSciences! My goal has always been to increase quality-of-life with healthy habits that are sustainable, efficient, and effective. I do this by covering topics like Fitness, Nutrition, Sleep, Cognition, Finance and Minimalism. You can read more about me here.

Sources: