Before we can get into any of the fun stuff (401k, IRA, Brokerage accounts, etc.), let’s be sure we know how to build the foundation of our financial life correctly and effectively. An emergency fund is the first thing you should start.

What is an emergency fund?

As the name suggests, an emergency fund is a sum of money that should be saved in case of emergencies. Emergencies could be an unexpected car breakdown, loss of employment, healthcare bill, or any combination of similar events. When these emergencies happen, and they inevitably will, you won’t need to worry about how they’re getting paid. It’s simple. You planned for an emergency with this fund and when the emergency happens, you don’t need to sweat it. You won’t be missing rent, you won’t be missing a credit card payment and you won’t be missing a utility bill. This is great because you never want to be late on any bill.

How much money should be in it?

Now that we know the importance of an emergency fund, let’s address how large it should be. Many financial experts suggest 3-6 months worth of living expenses. If you live in a dual income family or have a very stable income then I’d suggest shooting for 3 months. If you live in a single income family or don’t have a stable income then I’d suggest shooting for 6 months. Most likely you’ll fall somewhere in between. Then, to determine your monthly expenses, look at the budget you already created. Take that monthly budget figure and multiply it by the number of months you’re looking to save. For me, this can be seen below:

- Monthly Budget: $2,380

- 3 Month Emergency Fund: 3 (I live in a dual income household and have a stable income)

- Total: $7,140

I now know the amount of money I should always keep available in my emergency fund for when the inevitable emergency occurs.

Where should I keep my emergency fund?

This question is one that people don’t consider as much. You’ll want to keep your emergency fund in a high-yield savings account. These accounts are FDIC insured so you don’t have to worry about risk. They also provide an interest rate that’s likely way higher than your current savings account. For example, the national average interest rate for a savings account is about .1%. This is abysmal and doesn’t come close to keeping up with inflation (~2%). And, if your savings account interest rate doesn’t keep up with inflation, your money is worth less over time.

What I’d recommend you do is login to your current savings account online, locate your APY or interest rate and see what it is compared to other high-yield savings accounts available. If it’s 1% less than what others are offering, you may want to considering switching. Below, are some of the accounts I recommend:

- Ally Bank: 2.2% APY ***My Recommendation***

- Citizen’s Access: 2.35% APY (need a $5,000 minimum account balance)

- Wealthfront: 2.51% APY

There are many other high-yield savings accounts available. You’ll want to research what suites your needs best (APY, fees, balance requirements, initial deposit minimums, etc.) but I’ve found that Ally Bank is the best choice for most.

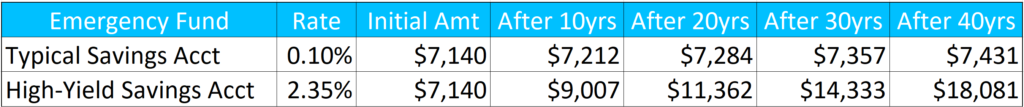

If you aren’t aware of the importance of interest rates, please see the chart below. Below, is an example of how much your emergency fund is worth over 40 years with a typical savings account versus a high-yield savings account.

Why you shouldn’t maintain a large emergency fund.

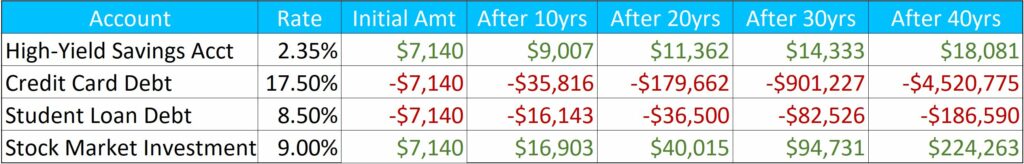

Emergency funds are important for everyone but as you progress in your financial journey, they can hold you back. It’s likely that your money can be doing more beneficial things for you rather than sitting in a savings account at 2.35% APY. So, although it’s important to have enough money saved up to comfortably handle a variety of emergencies, don’t get emergency fund happy. Here are two reasons why:

- Your money can work harder for you elsewhere. You could:

a) Pay off credit card debt that accumulates interest at an average rate around 15-20%

b) Pay off student loan debt that accumulates interest at an average rate around 5-12%

c) Contribute to a tax-advantaged account like a 401k or IRA

d) Invest in the stock market that grows around 8-10% per year - There are alternatives available if the situation gets too messy. You could:

a) Use a low-interest credit card

b) Apply for a personal loan or cash advance

c) Withdraw from your Roth IRA if you have one

d) Get a HELOC (home equity line of credit) if you’re a homeowner

Emergency funds are only step 1 in your financial journey. Complete it well and move on. I’ll be posting the next steps to financial health and freedom soon.

Summary

Wherever you’re at in your financial journey, it’s always important to start with a solid foundation. Nothing is going to hurt you more than an emergency without any funds available to pay for it. You’ll either hurt your credit score, be stuck with a high rate short-term loan and/or be late on your bills. Let’s avoid all this. Let’s execute emergency funds correctly and effectively. Then, let’s move on to something better!

If you liked this post, please subscribe to the weekly newsletter and follow the social media accounts for the latest content!

Disclosure: I frequently review or recommend products and services that I own and use. If you buy these products or services using the links on this site, I receive a small referral commission. This doesn’t impact my review or recommendation.