We’ve come to what may be the hardest step of all. But, it can also be the most rewarding. Maxing out your 401k. You’ll want to make sure your personal finances are in order before you start this step. That means making sure you’ve followed my first five steps to financial freedom closely. Now, let’s get on to creating a multi-million dollar retirement fund.

- Step 1: Building a Proper Emergency Fund

- Step 2: Get Your Employer Match (401k)

- Step 3: Pay Off All Debt (Except the House)

- Step 4: Max Out Your Roth IRA

- Step 5: Max Out Your HSA

Overview

If you haven’t read Step 2: Get Your Employer Match (401k) then you should read that first. In that post, I’ve detailed what a 401k is, how the taxes work, and where you should invest your money. I won’t be writing about these three items again and will assume you already have that knowledge. But, I will dive in deeper during this post to describe the process that’ll have you living large in retirement.

What is the 401k Max?

The maximum contribution you can make to your 401k for 2019 is $19,000. There’s also an additional $6,000 you can contribute if you’re 50 or older. This may seem like a lot of money because it is. But, I’ll mention two things. 1) You do need a higher than average income and controlled spending to max out your 401k. Don’t worry though, I’ll be posting about negotiating your salary, asking for a raise, and controlling your spending in the months to come. 2) You’ll end up saving a lot of money on taxes by contributing to your 401k because it’s a tax deferred account. So if you contribute $1,000 per month to your 401k, it’s likely that your paycheck will only decrease by $750 due to the tax benefits. Therefore, it doesn’t feel as bad in your day-to-day financial life as you’d expect.

Why Start Maxing Your 401k Now?

Because of compounding interest. The sooner you start investing in a 401k, the sooner your money can accumulate interest. And the sooner your accumulated interest has time to accumulate more interest. And that’s an amazing thing because not only are your contributions making you money, but your made money will make you more money.

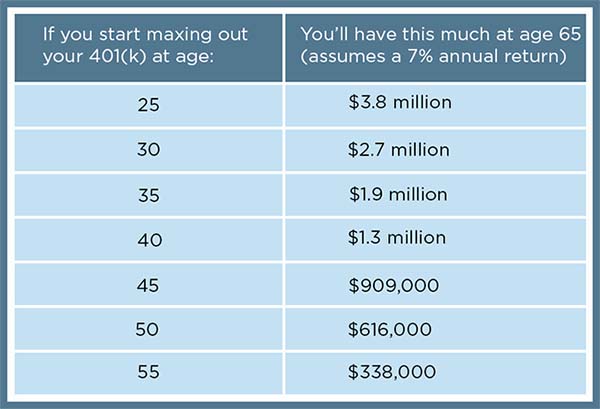

To detail this out, let’s look at the chart below. Let’s assume you max out your 401k (make $19,000 contributions per year) every year. If you started maxing out your 401k at age 25 with a 7% return, you’d end up with $3.8 million by the age of 65. But, if you waited until you were 35 to start, you’d end up with $1.9 million. So, by waiting 10 years to start contributing, you would have contributed $190,000 less in your lifetime but your ending balance would be $1.9 million less. Or in other words, your balance would be cut in half and you’d have missed out on $1.7 million. That’s a lot of money. And not money we should be leaving on the table if possible. And that’s all because your money and the interest has less time to compound and grow. So please, start early.

What’s the most effective way to contribute?

The most effective way to contribute is if you automate your contributions. I always recommend automating your finances because if you don’t, you’re likely to forget or use that money elsewhere. And if you do remember later in the year, you’ll be scrambling to contribute larger lump sums into your account rather than the small automated contributions you could make. So please, automate your contributions.

- Example Salary: $75,000

- Biweekly Paycheck After Taxes Without A Contribution: $2,102

- If You Did Automated Biweekly Contributions of: $19,000 max / 26 weeks = ~$730

- Biweekly Paycheck After Taxes With Maxing Contributions: $1,579

- Difference in Paycheck With/Without Contributions: $523

From this example above, you can see that even though you’re contributing $730 every other week to your 401k, you’re only seeing $523 less in your paycheck. This is because you’re saving over $200 in taxes every other week or about $5,400 per year. That’s a lot of money you could be saving by contributing the max.

Calculate Your Potential

So, what do you get out of maxing your 401k? Let’s run the numbers and find out. I recommend using this investment calculator for a quick and easy view of your potential. Here’s how it will play out if you started a 401k today at 28 years old and invested the maximum amount each year until 60 years old (this doesn’t even include an employer match).

- Starting Age: 28

- Retirement Age: 60

- Retirement Account Starting Value: $0.00

- Monthly Contributions: $1,583

- Rate of Return: 7% (average return of a target date fund)

Within the past two years, I’ve contributed approximately $10,000 per year to my 401k. With investment growth and my employer match, my account now sits at $26,000. Next year, I’m hoping that by cutting my housing and gym costs, and increasing my salary, that I’ll be able to max out my 401k. If I can find a way to make this happen, I’ll have set myself on a path to a $3.5 million retirement fund by 65. So please, max out your 401k.

Summary

Maxing out your 401k may be the most difficult step due to the $19,000 contribution limit per year. But, with tax benefits it won’t feel as bad as it looks. And when you retire with a boatload of money, you’re never going to regret the little sacrifices you made early on in life, for the abundance of security and joy later.

So start investing as early as you can. Try to max out your 401k through steady, automated contributions. And be proud of your progress along the way.

I’ve found saving and growing to be way more fulfilling than spending and not caring.

If you liked this post, please subscribe to the weekly newsletter and follow the social media accounts for the latest content!

Disclosure: I frequently review or recommend products and services that I own and use. If you buy these products or services using the links on this site, I receive a small referral commission. This doesn’t impact my review or recommendation.