I use to be in debt by over $100,000 which was mostly due to student loans (undergrad and graduate school). Back when I had that much debt, it was daunting and depressing. I was 22, owed $100,000 and only made about half that amount in salary. I knew I not only wasn’t going to have any money for the next 5+ years, but I also knew I was extremely limited. I wouldn’t be able to take advantage of any great opportunities that may arise. This burden even caused me to talk to my doctor about the mental toll it was taking on me. Fast forward 6 years and I’m debt free. All of my financial stress is gone. And I feel a sense of security and opportunity that I’ve never felt before. This is why I believe successfully completing Step 3, Pay Off All Debt, may have the largest impact on your health and happiness.

But, I’d only recommend you start this journey once you’ve built a proper emergency fund and have taken advantage of your employer’s match if they offer one.

What’s Considered Debt?

Debt is any money you owe someone else. This means student loans, auto loans, credit cards, personal loans and any other agreement where you owe someone else money. A mortgage on a house is also debt but we’re excluding mortgage payback in this step.

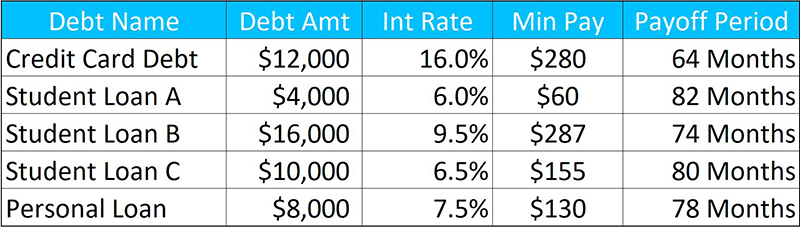

First, you’ll want to put together a list of every debt you owe with the following fields:

- Debt Name

- Debt Amount

- Interest Rate

- Minimum Payment

- Payoff Date/Period

Below, is an example of various forms of debt that you may have. Try to generate a list like this for yourself that you keep up-to-date every month.

In what order should I pay them off?

There are two common recommendations for paying off your debt. What they both have in common is to always pay the minimum amount owed each month first. So, I’d recommend you setup automatic monthly payments to each of your debt accounts for the minimum amount to avoid late fees. After completing this, you’ll have to decide what strategy to use for additional payments above the minimum to pay them off quicker.

Method A (Snowball) is to pay off the smallest debt amount first. In the example above, you’d pay any extra money you have to Student Loan A since it’s the smallest amount at $4,000. Once payed off, you’ll start on the Personal Loan at $8,000. This method has been recommended from a morale, momentum and ease-of-management standpoint because you can quickly start paying off the number of debts owed. This will snowball quickly in the beginning and make you feel like you’re paying off your debt fast because you have a lower number of debt accounts. Although this strategy has been recommended frequently, it’s not the fastest way to payoff your debt. And, if you want to increase your morale, in my opinion, knowing I’m using the quickest debt payoff method (Method B) does the trick in and of itself.

Method B (Avalanche). The quickest method. Pay any extra money you have to the debt account with the highest interest rate. In the example above, you’d start with the Credit Card Debt at 16%. Once payed off, you’ll start on Student Loan B at 9.5%. This method is the quickest because you’ll accrue less interest over time, and your payoff date will be sooner than method B.

But, decide which method is suited better for your situation. Are you struggling with starting to pay off debt? The snowball method may help with those feelings. Are you already motivated to pay off debt as fast as possible? The avalanche method may help you do that.

Does the method matter?

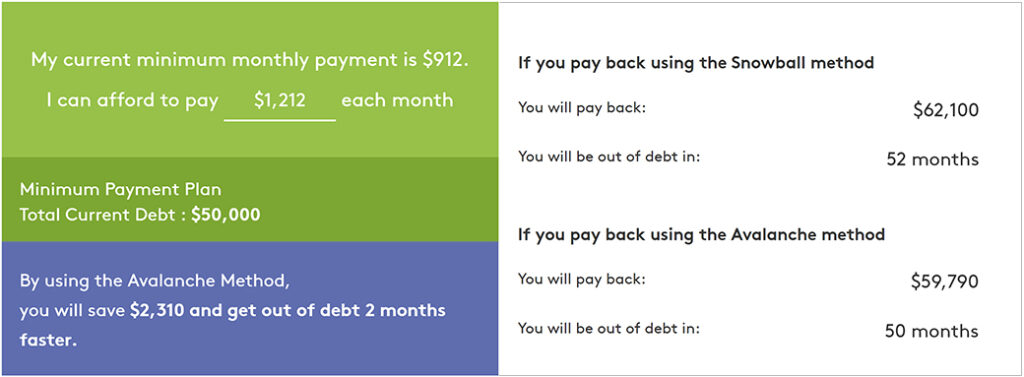

If you’re unsure how Method B is better/quicker than Method A, let’s run the numbers. The example below uses the numbers from the chart above. It assumes you’re paying the minimum amount on each account every month plus as extra $300 using Method A (Snowball) or B (Avalanche).

As you can see from the chart above, method B will save you $2,310 and get you out of debt two months quicker. This is why I recommend method B. It’s the best mathematical approach. But, if method A works for you, it’s still better than only paying the minimum on each loan which would cost you an extra $7,000 in interest. And, the real goal is to just get out of debt because the interest adds up fast.

How to Pay Off Debt Faster

Now, if you already have a lot of debt then your cash flow is likely restricted. The minimum payments for all those accounts add up and leave you with less money in the end. That’s why paying off debt is so critical because you can regain the income you work so hard for. That’s why I’ve come up with a list of ways to pay off debt faster if you’re in this situation.

Spend Less

One of the easiest and most obvious options is to spend less. If you spend less money, you’ll have more money available to pay down your debt faster. Here are some ideas and areas to focus on when attempting to spend less:

- Housing – This is the largest expense by far for most people. Are you paying extra for private parking, a balcony, an extra bedroom or bathroom, a ritzy location, or luxury amenities? It’s key to analyze everything that you’re paying for with housing to determine what you need to be happy and what you get sold on for various other unimportant reasons. Also, can you live with a roommate? Can you move in with your parents for a few years? These options do have some limitations and negative connotations, but they could save you thousands of dollars a year. It’s important to seriously consider these options as they can really help you out financially.

- Transportation – This is the second largest expense for most people. While transportation is needed to get you to and from work, the supermarket and various other places, cars are getting more and more expensive. People are also more and more interested in luxury cars with added features. And, a car is one of your largest expenses that depreciates quickly over time. Instead of purchasing a new car with all the bells and whistles, look to buy a three year old used car off of a lease. Once you have your car, use it as long as possible. Don’t get caught up in replacing your car every few years or leasing. And, if you live in a city, are you able to live without a car by using Uber, Lyft, public transportation or biking? These options could save you thousands of dollars a year too.

- Food – This is the third largest expense for most people. And while everyone needs food to live, there are a few ways to cut down on your food expenses. The biggest one is deciding to eat in or cook rather than ordering out. While this takes more planning, your food costs can be cut in half. You can also look to get your ingredients from a local farmer’s market or Aldi’s to save some money. You can even use couponing to cut costs even more. While I look to cut my costs using these methods, I never sacrifice on quality for health reasons. I still stick with organic, non-GMO ingredients because future health problems will likely be way worse than your food cost savings today.

- Hobbies – Depending on your hobbies, they can become very expensive. Golf can cost someone around $10,000 a year. Hunting, world traveling, and horse back riding can cost thousands too. It’s easy to find other hobbies that you can enjoy just as much, but while also saving tons of money. My favorite hobbies include working out at home, running, or having family game nights which are all super low cost. It’s possible to find hobbies that are just as fun free as those that cost thousands.

- Services – Subscriptions and monthly services can add up quickly too. Between Netflix, Amazon, HBO, telephone line, cable TV, gym membership, and various software subscriptions, the average person spends around $2,848 per year. And, most of these services you can live without while still being just as happy and healthy.

- Pets – Most people don’t fully consider the costs of pets. Everyone thinks of the food costs but what about insurance, vet bills, medications, treats, collars, toys, and training? A new pet can cost you more than $2,000 the first year and almost $1,000 every year after depending on your habits. Now, say you have multiple pets, and this figure can add up quickly. So, before you go buy a pet, consider the financial consequences and run the numbers.

Make More

You can only cut your spending so much because many things like housing, transportation, and food are needed to survive. The good thing is, there isn’t any real limit on how much money you can make. Therefore, making more money will always be a viable option to help you get out of debt faster. Here are some ideas and areas to focus on when attempting to make more:

- Ask for a Raise – This is the quickest and safest option. You most likely already have a job, and if you’ve been one of the highest performers in your area, you probably deserve a raise anyways. Put together a good case why you’re worth the extra money and present it to your supervisor. There’s rarely any harm even if the answer is no.

- Work a Second Job – My sister works a full-time 9-5 job at a bank with decent pay. But she’s been in over her head with student loans too so she’s worked not only a second, but a third job for the past 5+ years. She works a couple days a week at a rehab center and picks up shifts at a retailer as well. These two extra jobs have helped raise her income and accelerate her debt payment plan.

- Start a Side Hustle – A side hustle is another interesting option. Whether it’s flipping Ebay or Craigslist items, freelancing, renting your spare bedroom, investing in real estate, or teaching, there’s tons of ways side hustles can earn you some extra cash. And, if you’re lucky, then one day your side hustle could end up growing into your main hustle.

Lower Interest Rates

Another option may be to lower your interest rates. The higher the interest rate, the longer it will take you to pay off the debt. Just as compound interest can be amazing for investing, compound interest can be just as devastating for debt repayment.

- Balance Transfer – Consider transferring your balance from one account to another. For example, say you have a credit card with an interest rate of 5%. It’s likely that there’s another credit card you could open up with a 0% interest rate for a temporary period of time (sometimes up to 18 months interest free). Run the numbers and see how much you could save by transferring your balance to another account to help pay it off quicker.

- Negotiate Interest Rates – A lot of times, as with the example above, companies know you may perform a balance transfer to save money. If those companies know that you’re considering that option, they may be willing to lower your interest rate for a certain period of time if you stay with them to pay off the debt. So, contact the companies to which you owe debt and tell them you’re considering a balance transfer if that company isn’t going to lower their interest rate. It may not always work, but it’s definitely worth the ten minute call for hundreds of dollars in potential savings.

Mortgage Exception

With Step 3, Pay Off All Debt, the only debt that’s not included is a mortgage. Since a mortgage can be an appreciating asset, with a low interest rate, it’s possible that using your money for other investments will be a more productive. That’s why paying off your mortgage will be covered in Step 7 – Setup Your Rich Life.

Summary

If you’ve been following my investing steps to financial freedom then this is the step where you become debt-free (excluding a mortgage). This is the step where you no longer have to worry about debts and interest rates. This is the step where you can alleviate your financial stress, obtain financial security, and set yourself up for all new opportunities in life. I can tell you from experience that becoming debt-free was one of my biggest financial accomplishments. An accomplishment that has made me happier and healthier. So I challenge you to step up and strive for a debt-free life.

If you liked this post, please subscribe to the weekly newsletter and follow the social media accounts for the latest content!

Disclosure: I frequently review or recommend products and services that I own and use. If you buy these products or services using the links on this site, I receive a small referral commission. This doesn’t impact my review or recommendation.