Throughout all of college I focused on learning, athletics and visiting my family. I never really thought about the cost of my meal plan, apartment and education. I assumed like most, that this is what college was and what everyone did. You focus on your schooling, interests and social life while allowing all of your expenses to be put on loans or some sort of debt. Eventually, when you got a job after college, everything would work itself out and your job would easily pay back all the accumulated debt. Well, 150 thousand dollars later, it turns out that almost any job would make paying back this amount of debt quite difficult. And, with a ~7% interest rate, that meant my debt was growing by around $10,500 a year. That meant, I needed to pay $10,500 each year just to keep my debt from growing. Wow… that realization shocked me. But, great lessons from my parents and education had taught me to be a problem solver and to see challenges as opportunities. With that mindset instilled in me, I put together an aggressive plan that helped me pay back all my debt within 6 years. And now, I’m using that same plan to invest and grow my wealth each month.

Create a Simple Budget

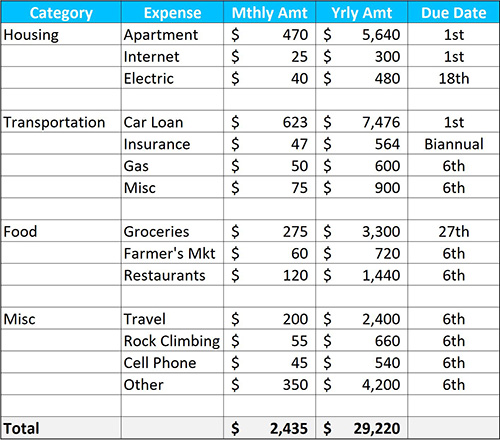

It turns out that personal finances are pretty similar to running a small business. The first thing I needed to do was create a budget. I needed to understand how much money I needed to live a healthy and sustainable life. This was quite similar to what I learned about how businesses need to understand how much money they require to stay open. To do this, I put together a simple Excel spreadsheet. First, I identified the main categories for my budget. From my research, I identified that Housing, Transportation and Food consume nearly 70% of a person’s cost of living. Therefore, I used those three categories and a Miscellaneous category for my spreadsheet. I then identified each expense I incurred within those categories. For example, I rent an apartment that requires internet and electric. Therefore, these three expenses were all I needed for housing. I then filled out all my remaining expenses and input the monthly payment amounts. I still use this same budget today which you can see below. Currently, I need to make $2,435 each month to break-even and not go into debt as long as my spending is in line with my budget.

If you don’t have a budget or it’s not working well, I suggest creating a spreadsheet like the one shown above. First, I like using four main categories for Housing, Transportation, Food and Miscellaneous to keep it simple but your categories may be different. Second, I like to identify my monthly expenses by reviewing all checking account and credit card statements for the past 3 months. This helps identify all my actual expenses rather than the only ones I can remember. Lastly, to identify my monthly expense amounts, I like to add up all purchases for a given expense line within the past three months and divide it by 3. This will show my average monthly spend for groceries, travel or any other expense over a small period of time. Just be sure to include all your expenses like minimum debt payments on credit cards and loans too. If you have yearly or biannual payments, put this in your budget too. Your budget should accurately represent your current cost of living. I also suggest you input an “other” expense line to account for one-time purchases that may not warrant a category. This “other” expense is like a buffer for anything you can’t think of purchasing regularly but will inevitably occur. Once you complete your budget, it should pretty accurately predict how much money you’re going to spend every month.

Perform An Income to Budget Analysis

Once you have your budget, the next thing to do is see if your income can support it. First, determine your net income. This is the amount of money you’ll see after taxes (Federal, State, Social Security, etc.) and deductions (Health Insurance, Dental Insurance, etc.). It’s the amount of money that gets deposited into your checking account. For example, say I’m making $60,000 per year or $5,000 a month. My net income on this salary after taxes and deductions may be around $40,000 per year or $3,333 a month. Second, take this monthly net income and subtract your monthly expenses. In this example, $3,333 – $2,435 = $898. That means my income can support my budget. Great. It also means I have $898 leftover each month that can be used to create an emergency fund, pay off more than a debt’s minimum payment, or be invested. If you’re not sure what to do with this leftover money, I recommend following these steps:

- Step 1: Building a Proper Emergency Fund

- Step 2: Get Your Employer Match (401k)

- Step 3: Pay Off High Interest Rate Debt Fast

- Step 4: Max Out Your Roth IRA

- Step 5: Max Out Your HSA

- Step 6: Max Out Your 401k

- Step 7: Strive to be Debt-Free

- Step 8: Setup Your Rich Life

Optimize Your Budget and Cash Flow

If your income can’t support your budget, or you’re looking to increase the amount of money leftover after expenses (which is almost always a great idea), then you’ll need to do one of two things. You’ll either need to reduce your budget/monthly expenses or increase your income. Both, are easier said than done but attainable with consistent effort and a willingness to adapt.

- Decrease Your Budget: Cutting back on spending can initially be difficult. You’re usually spending your money for a reason. You may have a nice apartment for the extra amenities, or Netflix for the vast entertainment selection, or eat out a lot for the convenience. But, these expenses may not all be necessary to live a healthy and sustainable life. For example, if you have monthly subscriptions for Netflix, Amazon Prime and Hulu, what would your life look like without one or all of them? You may love using these streaming services but once you eliminate them, you forget about it after a while and pick up new habits. I recommend reviewing each expense line in your budget to identify if its necessary for you to be happy and healthy. If it’s necessary, can the expense be reduced? I once had a gym membership for a while that cost me $165 a month. The gym was amazing. But, I decided it was too much and now share my girlfriend’s Beachbody on Demand membership for $100 a year. I now workout in my apartment and don’t have the luxury of a spa, restaurant and basketball court but I didn’t use 95% of the amenities anyways and it now saves me $1,880 per year. I’m happy with the decision. I’d recommend focusing on your biggest expenses first though. This is where you can find the most opportunity for savings in your budget. Reexamine your living situation, transportation and food habits. These initial, difficult choices to spend less become much easier months later once you become acclimated. Soon, you’ll be wondering why you didn’t make some of these decisions sooner.

- Increase Your Income: There are numerous ways you can increase your income. The easiest way is to get a raise. If you’re a high performer at your company, and you’ve been exceeding your expectations for a few months now, talk to your manager about a raise. Discuss how much value you’re bringing to the company and why you deserve more money. If your manager denies you a raise, find out why and discuss a path to a future raise. There’s almost always opportunity for income growth in your current position. If there aren’t opportunities for income growth in your position, another option would be to look for a new job. A lot of times, people can increase their income by switching jobs. When looking for a new job, look for positions that have increased responsibilities that you can fulfill. Increasing roles and responsibilities usually lead to a higher income. Also, be sure to negotiate your salary upon accepting a new position. It’s rare that the initial offer or listed salary is final. And, your starting salary is much easier to negotiate than future raises and promotions so it’s incredibly important to start off at a rate that makes you comfortable and happy. If you’re unable to get a raise or a higher paying job, you can also take on a side hustle. This could be working part time as a waiter, driving for Uber or making money online. There are tons of ways to make extra money if you’re willing to put in more time and effort. It can be difficult to raise your income, but if you change your mindset and start asking yourself “how can I make more money?” you’ll start coming up with a lot of ideas. And then it’s just a matter of executing those at a high level.

Maintain Your Budget

Whether your expenses or income change over time, it’s always important to maintain a budget. If you aren’t monitoring your personal finances, it’s nearly impossible to manage them. I recommend updating your budget to match your current spending habits at least once a year, and anytime a major financial event happens like switching your living arrangements or upgrading your car. Your budget should also be an accurate representation of your spending habits and not a long shot goal. If you’re consistently blowing your budget, it’s time to adjust your budget to match your habits or change your habits to match your budget. My goal is to have my expenses be as close to my budget as possible each month but realizing exactness isn’t possible, and therefore shooting to be under budget 50% of the time and above it 50% of the time.

It only takes a hour to create or update your budget. This one hour of financial planning can help you identify numerous ways to save thousands of dollars per year. In my opinion, it’s well worth the effort to not only create it, but to maintain it.

Final Thoughts

Creating a budget, analyzing my income to budget ratio and optimizing my personal finances has allowed me to run my personal finances on a surplus for years. This helped me pay off 150 thousands dollars of debt within 6 years and has since helped me save thousands of dollars in savings accounts, retirement accounts and brokerage accounts.

It doesn’t matter your current financial situation, you need to start monitoring and managing a budget to get an idea of what direction you’re heading. You can then use this information to accelerate your progress to a healthier and happier financial future. So please, spend a hour a year creating and managing a budget. Then, spend an additional 15 minutes a month to review your progress. It’s time well spent.

If you liked this post, please subscribe to the weekly newsletter and follow the social media accounts for the latest content!

Hey, I am Brandon Zerbe

Welcome to myHealthSciences! My goal has always been to increase quality-of-life with healthy habits that are sustainable, efficient and effective. I do this by covering topics like Cognitive Health, Fitness, Nutrition, Sleep, Financial Independence and Minimalism. You can read more about me here.

Sources:

Disclosure: I frequently review or recommend products and services that I own and use. If you buy these products or services using the links on this site, I receive a small referral commission. This doesn’t impact my review or recommendation.