My girlfriend and I spent the past two weeks completing a personal finance course called Financial Peace University. This course is put on by Dave Ramsey, one of the most well-known personal finance experts. It was a course that included 9 one-hour lessons, each with their own homework assignments and takeaways. Since my girlfriend and I were raised quite differently in regards to money, we’ve often struggled to talk about it. She characterizes her feelings about money with words like greed, ego and shame while I often use words like freedom, opportunity and options. With these two differing mindsets, we thought it’d be useful to go through a course together that would provide us with a common background of knowledge on the topic. After completing the course, there’s a lot we both learned and found beneficial but there were a few items in Dave’s courses that I disagreed with. Below, is my review on the course, the baby steps and how they compare to my steps to financial freedom.

Courses

To the right are the 9 courses we participated in. The baby steps, are Dave Ramsey’s recommendation for the order in which you should use your money. Learning his baby steps were the first four lessons of the program that I’ll cover in a bit. The remaining lessons, lessons 5-9, were courses on buyer behavior, insurance, retirement, real estate and generosity.

These remaining courses were pretty good. For me, the buyer beware lesson was probably the most interesting. This lesson talked about the comprehensive marketing plans companies deploy to get you to buy their product/service. From positioning products on shelves, to tracking your background and interests via social media, to providing relevant advertisements tailored to your spending habits, to timely coupons that create a sense of urgency and marketing that plays on your emotions. Companies do whatever they can to get your attention on their product/service and get a sale with your hard earned money. It’s a good lesson that makes you aware of these marketing strategies in order to help you control your spending habits. And, it’s something that’s becoming increasingly important as the convenience of buying items online has led to a significant increase in budget-breaking impulse buys. I think this knowledge will prove useful when I make future buying decisions.

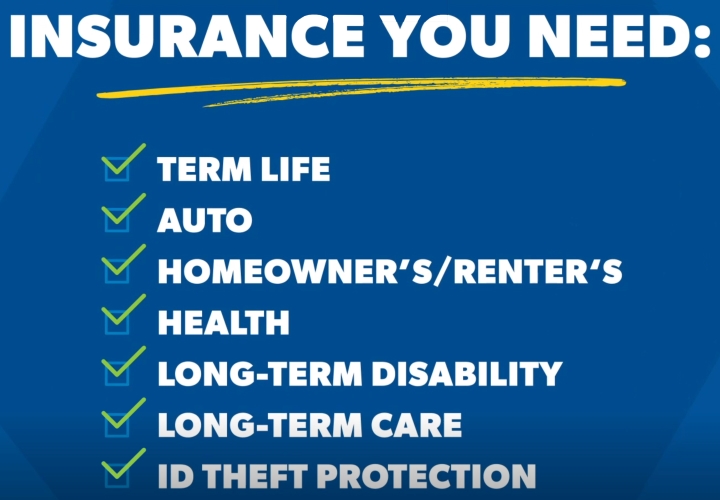

The most informative lesson for me was the role of insurance. I’ve only been on my own health insurance for a couple years now and am still included on my family’s auto insurance plan so I’m not that familiar with insurance. I’ve also never purchased renter’s, life, disability or long-term care insurance either. My belief has been that if you have a well funded emergency fund, that should cover almost all situations otherwise covered by insurance. And, by skipping insurance for an emergency fund, you’ll save a lot of money on average in the long run. While most of my beliefs were confirmed by Dave Ramsey, he did talk the 7 types of insurance he believes everyone should have or be aware of. They can be seen below. So while I’m not planning to change my insurance situation, I still learned a lot about the topic and will use the information moving forward.

The retirement planning lesson was useful but we were both pretty familiar with retirement planning to begin with. I’ll talk more about that in a bit as well. The real estate & mortgage lesson was probably the least interesting for both of us only because we aren’t interested in buying a house anytime soon. But, the main takeaway was to use a 15-year fixed rate mortgage with at least a 10% down payment when buying a house. And the generosity lesson was my girlfriend’s favorite lesson. It talked about the power of giving to those in need. I found this lesson to be good as well and will shed more light on it in a bit.

Baby Step Comparison

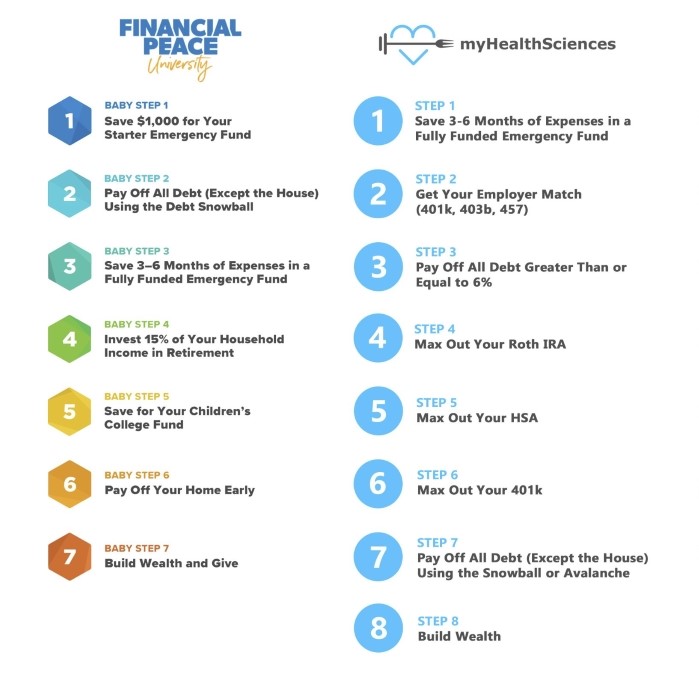

Now let’s discuss Dave Ramsey’s Baby Steps. This is the order in which Dave recommends you use your money. They were fairly similar to the steps I’ve outlined for reaching financial independence but with a few differences. Below, you can see the step-by-step comparison chart.

Right off the bat you can see a few differences in our beliefs in terms of when you should create an emergency fund, invest in retirement or pay off debt. Throughout the course, I kept our differences in mind and tried to analyze it from his perspective. Here are my takeaways on the differences:

What I’ve Changed My Mind On

Debt Payoff Importance

The first thing I’ve changed my mind on is the importance of paying off debt. From the steps above, you can see that I have two separate steps for paying off debt. With my Step 3 I recommended paying off debt with an interest rate greater than or equal to 6%. After that, I recommended funding an IRA, HSA and 401k before paying off any remaining debt. I initially followed these steps because mathematically they produce the best rate of return. With an IRA, HSA or 401k account, you should be able to make an ~8% return. Therefore, it’d be best to invest your money in these accounts with an 8% return instead of paying off that lower interest rate debt of 6% and below. And while this mathematically is still true, I think there are many dangers of carrying debt and dangers of becoming comfortable with it that I didn’t previously consider. For example:

- By becoming debt free, your stress levels are decreased. There’s a sense of peace that comes with not owing anyone anything. And in emergencies, like if you lost your job, you won’t have debt payments owed. That can reduce a lot of stress in those already stressful situations.

- By focusing on one step at a time you can attack that step with full focus and intensity. Instead of making the minimum payments on debt while also funding a retirement account, it’s much more motivating to throw all your money at debt first, celebrate when it’s gone and then attack retirement with that same focus and intensity.

- By paying off debt first, you have more cash flow to fund retirement. For example, instead of trying to fund retirement while having a $600/month car payment, $500/month student loan payment and a $100/month credit card payment, you now have $1,200 extra each month when debt-free to contribute solely to retirement. That’s a lot of cash flow you’ve regained to invest in your future.

- By not having debt, it simplifies your finances. I think this is a big one for me too since I practice minimalism. Without student loans, credit card debt, auto loans or any other outstanding debt, my personal finances become simple. That makes it easier to manage day-to-day and easier to plan month-to-month.

Therefore, besides receiving an employer match which is free money (my step 2), I’ve decided it’s best to pay off all outstanding debt besides a mortgage before funding retirement accounts. Yes, mathematically it’s best to perform the steps based on interest rates and rate of return, but the stress, complexities and limitation of cash flow now has me believing that becoming debt-free is best. Only then, should retirement accounts be funded further.

Give

The second thing I’ve changed my mind on is giving. While I’ve always been interested in giving back eventually, I’ve never made it a clear goal of mine. In Dave Ramsey’s baby steps, he makes it very clear how important giving back is once your finances are in order. He talks about the joy he finds in paying for someone else’s dinner bill, or helping someone out with their grocery bill or donating money to fund local charities. I think this is something that can be very powerful once your finances are covered. For example, being able to fund entire family vacations sounds awesome. Being able to execute random acts of kindness sounds fun. Giving back to my high school to fund growth of future generations sounds rewarding. I think giving back to help others get where you’ve gotten is a good way to spend your money. Therefore, I’ve decided to change my last step to include giving back.

What I Disagree With

Emergency Fund

The first thing I disagree with is the importance of an emergency fund. Dave believes you should only have $1,000 in the bank before paying off all debt. I believe it’s more important to start with a fully funded emergency fund. I think when emergencies happen, like the current pandemic, it’s much more important to have at least 3 months of expenses in the bank. This will ensure you avoid missing rent payments or opening new forms of debt that could be crippling. It also ensures you have food on the table and time to get your life back together. These sound much more important to me than having debt looming overhead. That’s why I still believe having a fully funded emergency fund should be the first step in your financial journey.

Employer Match

The second thing I disagree with is getting an employer match on a 401k, 403b or 457 before paying off debt. Dave believes it’s more important to pay off all debt before even looking at retirement. For me, I think it’s best to get the employer match first. It’s free money. It’s a 100% return on investment. It’s not something I want to give up. And, with employer’s usually only matching between 3-6% of your annual salary, it shouldn’t restrict your cash flow enough to limit your debt repayment intensity. That’s why I think you get the employer match and only the employer match before applying sole focus to eliminating all outstanding debt.

My Updated Steps to Financial Freedom

With these changes to my beliefs and mindset, I’ll be updating my steps to financial freedom as shown below. My Step 3 has been updated to pay off all debt outside of a mortgage which eliminates step 7. That means my previous Step 8 (Build Wealth) will turn into the new Step 7. Then, Step 7 will be updated to include giving back as mentioned above. I’ll be making the changes to my relevant blog posts shortly.

Other Things I Disagree With

4 Fund Portfolio and Certified Financial Planner

Outside of the baby steps, there’s two other things I disagree with that I thought was worth mentioning. When Dave talks about investing, he recommends an approach of using 4 different mutual funds that cover the growth, growth and income, aggressive growth and international sectors. But, he never gets into much detail during this investing step and recommends you talk to a “SmartVestor pro” for advice on fund choice and allocation. This to me sounds more like an up-sell. If you want to know the details, he recommends you pay for a financial advisor in his network. The thing is, investing isn’t that complicated for most people. Once you know the basics, you can do the investing yourself without an advisor and save tens of thousands of dollars in fees. That’s why I’m choosing to skip a financial advisor and invest my retirement money in a low-cost retirement date fund. Specifically, I go to Vanguard’s target date fund section, select my expected retirement date and invest in the fund it recommends. These funds offer the diversification and re-balancing that Dave Ramsey suggests using a financial advisor for, but saves you tons of money on fees while also making you feel totally in control of your finances. That’s why I skip using a financial advisor and do the investing myself.

Credit Cards

Dave also suggests that you never use a credit card. He recommends cash or a debit card because you feel/see transactions happen and are less likely to make unnecessary purchases. While I think this is true, most people do spend more money using a credit card rather than a debit card or cash, I think there’s a way to mitigate this. Create and maintain a budget. Once you know how much money you have allocated to things like clothes, restaurants and online shopping, it’s easier to not overspend. The budget will manage the spending for you and mitigate this risk.

On top of that, credit cards can offer you 2% cash back. While this isn’t a lot, why not save an extra ~$600/year using a credit card over a debit card or cash? And, why not use a credit card to build your credit score in case you are required to finance a car or house? That’s why I recommend creating a budget to mitigate the risks of a credit card while still using it for all my purchases because I want the extra 2% cash back. It’s not a lot of extra money, but it’s better than nothing. Obviously, paying off that credit card in full every month is the only way this works though. If you’re retaining a balance and collecting interest, the 2% cash back is nothing compared to the 25% interest you may be accumulating. So, be smart and use a credit card wisely as a tool in your financial journey.

Final Thoughts

Despite everything mentioned above, Dave and I had more similarities in our beliefs and mindsets than differences. We both prioritize budgeting, emergency funds, debt repayment, retirement investing and building wealth. We both believe in being intentional with our purchases and not relying on impulses. We both find that making sacrifices in the short term will lead to success, health and happiness in the long term. I liked Dave’s lessons and look forward to applying them in the future.

In regards to my girlfriend and I, we definitely enjoyed the course. Dedicating a hour each night to learn and discuss the topic was very beneficial for us. We both gained a better understanding of each other’s mindset and beliefs about money. We then created financial goals together and put a budget in place to get us there. We also learned a framework that both of us can follow to achieve these goals. And, we did it all together. It was a rewarding experience to spend time with your partner doing something productive that will impact our future. I definitely recommend this course for couples looking to get on the same page financially.

If you liked this post, please subscribe to the weekly newsletter and follow the social media accounts for the latest content!

Hey, I am Brandon Zerbe

Welcome to myHealthSciences! My goal has always been to increase quality-of-life with healthy habits that are sustainable, efficient and effective. I do this by covering topics like Fitness, Nutrition, Sleep, Cognitive Health, Financial Independence and Minimalism. You can read more about me here.

Disclosure: I frequently review or recommend products and services that I own and use. If you buy these products or services using the links on this site, I receive a small referral commission. This doesn’t impact my review or recommendation.