I went from gaining 30% per year on my investments to losing $75,000 in 6 months. It wasn’t easy. I’ve invested every paycheck into the stock market for months, yet my net worth is somehow lower now than it was a year ago. What’s happening? Why is the market tanking? And what strategies am I following to counter it? Well, let’s get into it!

What’s Happening in The Market?

Let me give a brief oversimplification of what’s happening in the market. Two years ago, a pandemic happened. Everyone locked themselves in their bedroom, businesses shut down, and the economy came to a halt. The market crashed. Stocks dropped 26% in four days, marking one of the biggest crashes in history. [1]

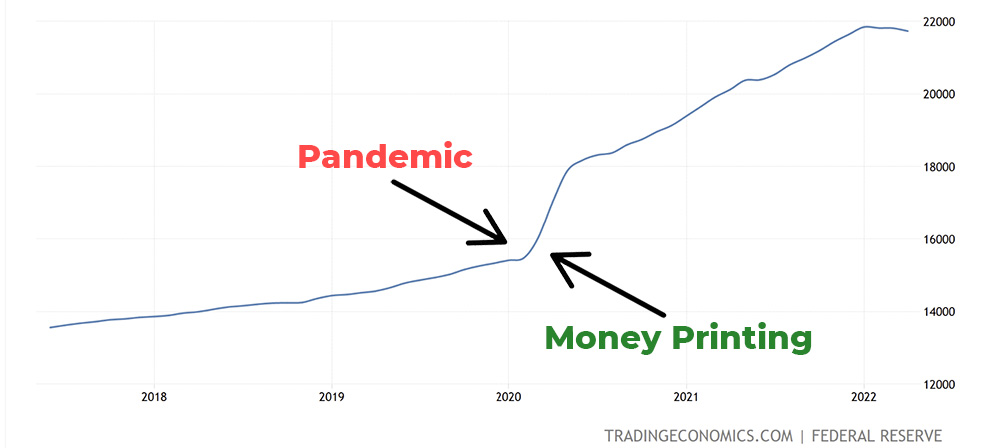

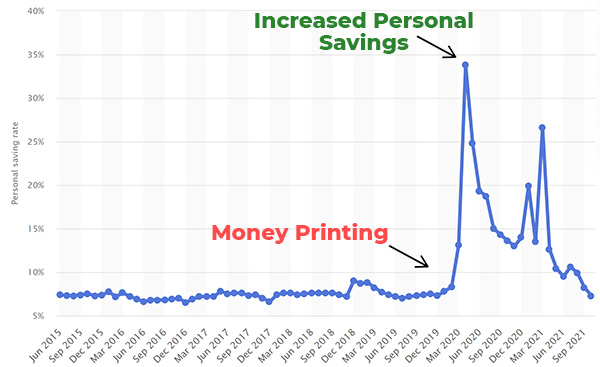

In response, the government did everything they could to prevent a recession or depression. They printed money. Each person and their dead grandmother got a thousand-dollar check. And if that wasn’t enough, they did it again. And again. In total raising the amount of money circulating in the United States by >35% [2]. Many people were better off financially after the crash than before it.

This prevented a recession. But it provided many of us with extra cash that increased our personal savings rate by 2-3x [3]. We could now afford to buy more than before the pandemic and started spending again. Spending a lot! Companies increased their prices across the board because customers could pay for it. This, along with supply chain issues and the war in Ukraine led to inflation. An 8.6% rise in the Consumer Price Index is the most inflation we’ve seen since 1981. That’s high.

To stem inflation, the government is now raising the federal funds interest rate. The rise in the federal funds rate means you’ll earn more interest in a savings account but it’ll cost more to borrow money. This should increase savings, slow spending, and damper inflation. But with spending decreasing and inflation still not under control, the next big worry is a recession. If we’re not already in one yet, most people believe it’s mere months away. And that is why the stock market is crashing. A looming recession. So, what can you do about it?

What Am I Doing?

The stock market is in a bear market meaning it is down more than 20% from its all-time high. Since nearly all my investments are in the market, that results in a 20% drop in my portfolio. Or a loss of over $75,000. As I’ve talked about previously, I wouldn’t be investing without already having a 3-6 month emergency fund and no bad debt. But with these out of the way, I can focus on investing. And here’s how I’m handling the impending recession.

Buy Now / Sell Never

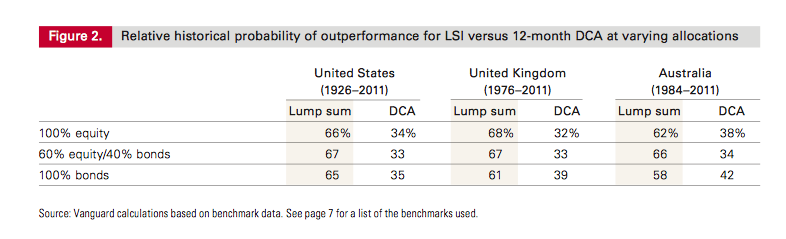

My rules of investing don’t change based on the market’s situation. Here’s why. When investing, I have three options: invest now, invest in scheduled increments (ex: every two weeks), or invest when I see fit. If I invest now, this is considered a lump sum investment. If I schedule my investments over time, this is considered dollar-cost averaging. I would be reducing my risk of market ups and downs by slowly investing over time. Many studies including this one from Vanguard show that lump-sum investing beats dollar-cost averaging 70% of the time. I like those chances. And this study was performed for 90 years even during recessions and depressions. Time in the market beats timing the market. So, I invest now. [5]

Don’t Time the Market

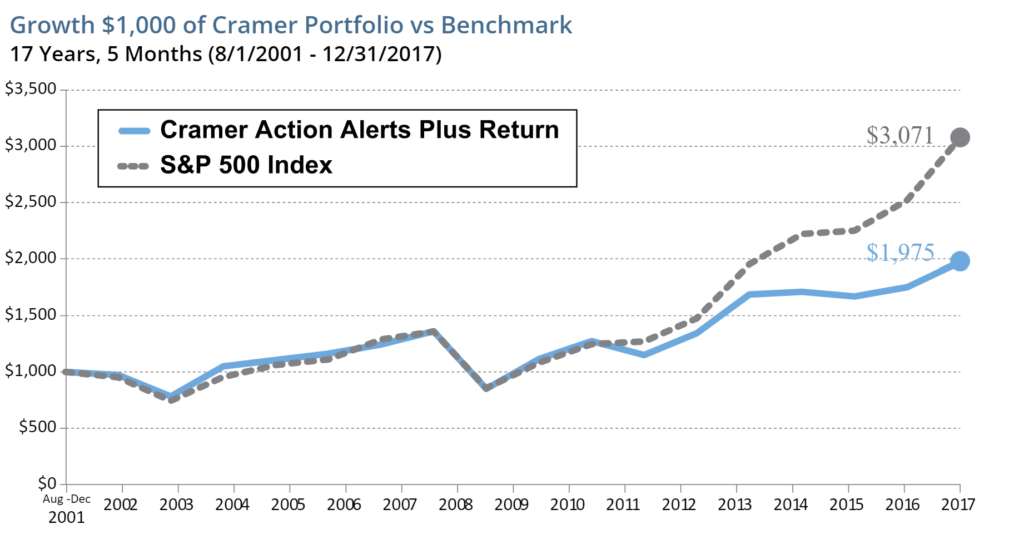

The third option is investing when I see fit. Or market timing. Maybe I think the market will continue going down, so I hold off on buying. Or even sell current investments. Maybe I have “insider” knowledge or listen to Jim Cramer and know that even during a recession, people still must buy toothpaste and shampoo so those companies should perform better [6]. Maybe I like the idea of actively managing my investments because I know what to buy and when to buy better than the average person. That’d be stupid.

Many studies, including this one from the school of Wharton show that investment expert Jim Cramer consistently loses against the market. I could pay for his premium service that alerts me when to buy and sell certain stocks and that’d cost me much more than the subscription fee. [7]

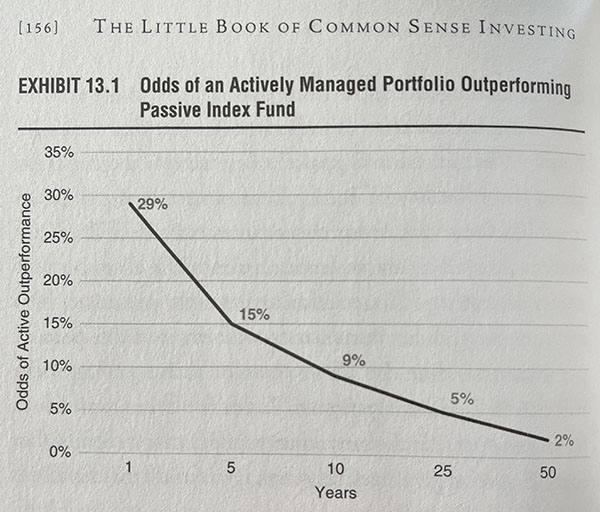

Invest in Passive Index Funds

Instead, I could opt to invest in the best actively managed funds available. I could look at which funds have performed the best over the past 5-10 years and let a fund manager make the decisions for me. With their experience, knowledge, and resources, their decisions will be better than mine. This too has proven stupid. Actively managed funds can beat the stock market average, but the chances are low. Say 30% per year [8]. Try to beat the market over multiple years and the odds drop dramatically. Any fund beating the market has likely done it by luck. And given more years to come, regression to the mean will likely prevail. So, what do I do instead?

Maintain Diversification

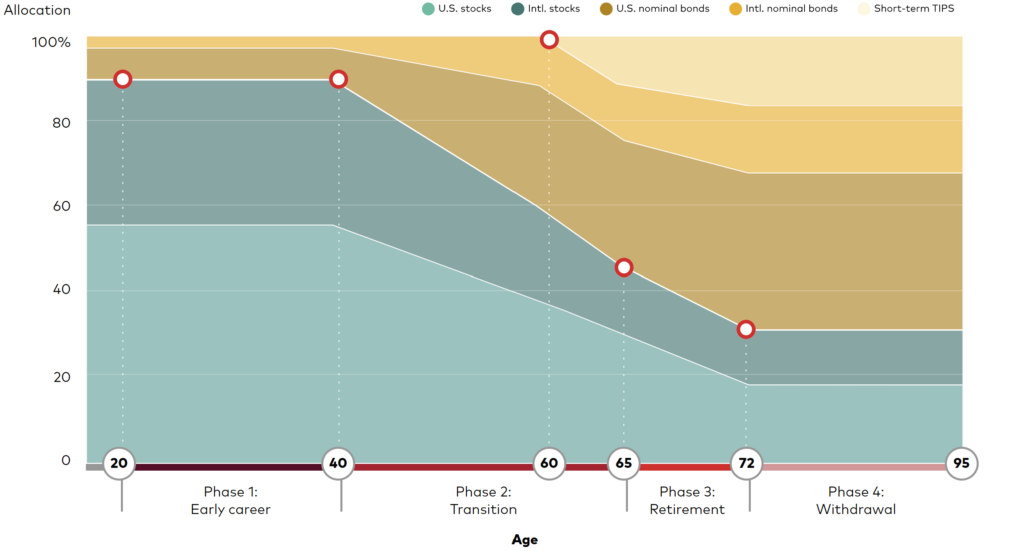

I realize no matter how much research I do, I don’t have the knowledge, experience, or resources to beat the market. I don’t know when to invest or what to invest in. So, I don’t fight it. I buy low-cost passive index funds that mirror the stock market. They perform exactly as the market does, beating money managers over 70% of the time. And I use Vanguard’s target date funds as a guide to successfully diversify my portfolio. When recessions are hitting and markets are volatile, I revert to this model to rebalance by funds for optimal diversification.

At 30 years old, I maintain 90% of my investments in passive stock index funds as recommended by Vanguard. 7% is invested in bonds and 3% is my small gamble in crypto. Although the market is crashing and a recession is looming, I can’t find any evidence of a better strategy than this. [9]

Final Thoughts

The pandemic shut down the economy leading to billions of dollars in government aid. This caused increased spending and prices to rise. Inflation has taken over, the fed is fighting it with increasing interest rates, and a recession is now looming as the market crashes. Despite all this, my rules of investing haven’t changed. The evidence hasn’t changed. If I have money to invest, I invest it now. Even if it means potentially losing more money. I put those investments in low-cost passive index funds that mirror Vanguard’s retirement recommendations. Even if stocks are being hit the hardest. Until I find statistical evidence otherwise, these are my financial habits for health excellence.

Hi, I’m Brandon Zerbe

Welcome to myHealthSciences! Every week I share habits for health excellence. I do this by covering topics like Fitness, Nutrition, Sleep, Cognition, Finance and Minimalism. You can learn more about me here.

Sources:

- [1] COVID-19 and the March 2020 Stock Market Crash

- [2] United States Money Supply M2

- [3] Personal Saving Rate in the United States from June 2015 to June 2021

- [4] Inflation Rose 8.6% in May, Highest Since 1981

- [5] How to Invest a Lump Sum of Money

- [6] Jim Cramer’s Advice

- [7] Jim Cramer vs. S&P 500: Chasing ‘Mad Money’

- [8] The Little Book of Common Sense Investing

- [9] Vanguard Target-date Funds