Step 6: Max Out Your 401k

We’ve come to what may be the hardest step of all. But, it can also be the most rewarding. Maxing out your 401k. You’ll want to make sure your personal finances are in order before…

We’ve come to what may be the hardest step of all. But, it can also be the most rewarding. Maxing out your 401k. You’ll want to make sure your personal finances are in order before…

What most people don’t know, is that a HSA can be an incredibly powerful investment vehicle. If you’ve completed the following steps, and have a HSA account, this post details why and how you should…

Well, vacations don’t have to be like that. I just got back from my first vacation this year, and with some thoughtful planning and great support, I can say I vacationed right. I feel refreshed and excited to get back to work. I spent what I had budgeted so I have no stress and am ready to start saving for the next. I maintained my nutrition and fitness goals. And, I’m super happy with the experience.

In this post, I’ll detail the things I did that made my vacation successful.

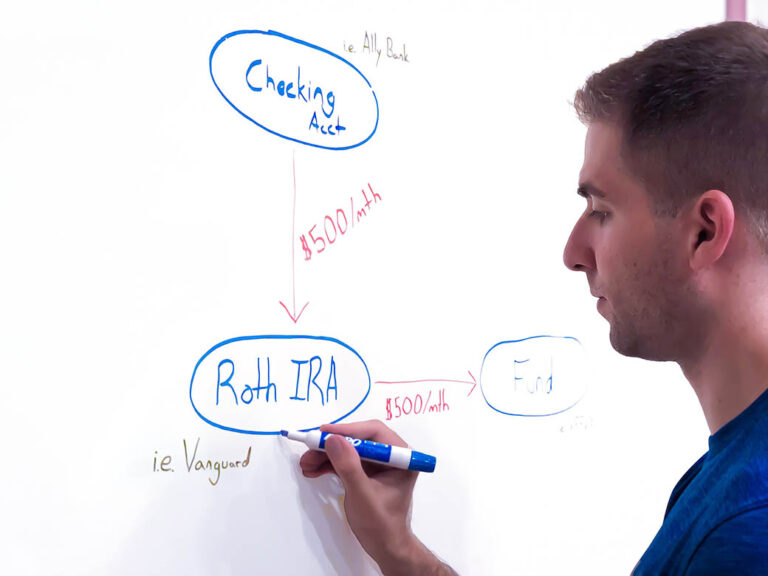

If you’re on step 4, you’re doing pretty well. You’ve built a proper emergency fund, are receiving an employer match, and have paid off all your debt. Now, you’re ready to start investing in your…

I use to be in debt by over $100,000 which was mostly due to student loans (undergrad and graduate school). Back when I had that much debt, it was daunting and depressing. I was 22,…

If you’ve completed step 1 in your financial journey of building a proper emergency fund, you’re ready for step 2. This step involves finding out if your company has a 401k, 403b (non-profit), or 457…

Before we can get into any of the fun stuff (401k, IRA, Brokerage accounts, etc.), let’s be sure we know how to build the foundation of our financial life correctly and effectively. An emergency fund…

Ever since being $150,000 in debt from student loans, I’ve been on a mission to continually learn more about finance and give myself the opportunity to achieve FIRE. Financially Independent Retiring Early; which translates to,…